trading

Chainlink — The First Mainstream Decentralized Oracle in Crypto

Chainlink is quickly becoming a household name in the DeFi sector and is poised to continue to make significant growth this year, positioning itself to be the most popular and successful decentralized oracle in crypto existence.

If there is one company that intends to bring interoperability in the blockchain ecosystem, then it is Chainlink, and it without a doubt has the first-mover advantage. Chainlink finds its foundational lineage in what we call Smart Contracts and was established in the year 2014. The people behind this revolutionary blockchain company are:

- CEO — Sergey Nazarov who also co-founded the company. He has a wide experience in blockchain and is credited to be one of the founding members of Secure Asset management.

- CTO- Steve Ellis also the co-founder also has been a part of the Secure Asset exchange platform.

- Other noted personalities who own a prominent position in the company are Ari Juels and Andrew Miller.

The ICO of Chainlink launched the LINK token in 2017, September. Out of the one billion tokens, 35% were available to users in the ICO.

What is Chainlink?

Some of the most prominent blockchain networks have always operated in isolation like Bitcoin, Ethereum, and others. Understandably there was no way that they could be connected. But interoperability aids users and developers to get their entryway to real-time data that exists outside the blockchain. We are all aware it was Bitcoin that introduced the concept of blockchain and decentralization. This was followed by Ethereum which explored its true meaning with smart contracts. Chainlink as the name itself suggests is the next step intending to revolutionize the blockchain industry by enabling smoother interaction with external data sources.

The Chainlink Solution

Different blockchains have different consensus mechanisms that restrict the free interaction between these chains. Chainlink solves this major concern by using a secure Oracle network for creating a decentralized solution. Never before has a blockchain project raised this issue and Chainlink happens to be the first of its kind. Its decentralized Oracle service is conjectured on Ethereum to make smart contracts more accessible and connected in general. Smart Contract was first introduced by Ethereum but it could only manage data on the blockchain. It did not allow us to create a connection with the real world. Chainlink helps in decentralizing the internet between blockchain and real-world applications.

Chainlink Nodes

Chainlink is a decentralized network of ChainLink nodes. Every node gives away the use of data feeds and APIs directly to the smart contract. The Chainlink network can be divided into two sections namely on-chain and off-chain that interact with each other to execute contracts. Smart contracts are devised on-chain but off-chain verify external data and send it back to on-chain.

Oracles also have a reputation system and singular identities that are its biggest proof of reliability. The network is built in a manner that calls for regular upgrades implying that different components in the network can be modified with technology trends. The users also can become node operators by connecting their API to Chainlink. The number of node operators has ever since increased.

Data can be retrieved from off-chain APIs and data pools which later can be incorporated into the blockchain with the use of oracles. Users can send their payments directly from their smart contracts to their bank accounts.

The role of Chainlink Smart contracts

Smart contracts are programs that offer trustless execution and believe in enabling frictionless transactions. Chainlink’s smart contracts include the working of oracles into contracts. These smart contracts provide decentralized oracle-feed to fulfill the conditions of the smart contract initially off-chain which later get converted into on-chain data. The differentiating factor is that it is an incentive-driven system that pools the gaps between real-world and blockchain peers.

Let’s talk about Oracles

Oracles are programs that are used to both retrieve and verify external data on blockchain networks and smart contracts.

How? With the use of market data feeds and web APIs.

For optimizing the use of Oracle, a data source is queried for distinct information that is connected back to a blockchain. Smart Contracts can be generated at this juncture to work on the necessitated information that flows from the data feed.

Chainlink is a decentralized oracle network that is open to anyone who is willing to participate in running an oracle. Every single Oracle is provided with an on-chain identity with a reputation that strengthens its reliability. Every single node in the network will have to stake LINK tokens which can be surrendered citing bad data. Due to this the network operates liberally discouraging bad data while maintaining the decentralized architecture.

How it prevents single Oracle vulnerabilities

It currently cuts down such vulnerabilities with three approaches. Data sent via the network is verified through majority voting preventing a single point of failure in the oracle system. It also issues a reputation and certification system for oracle performance. The hardware components protect the confidentiality of data so that private data can be easily transferred between oracles and smart contracts without any ado. Distribution of LINK tokens whenever bad data is spotted also is one of the ways to reduce such weaknesses.

LINK tokens

Chainlink launched its mainnet on the Ethereum network just last summer. LINK tokens are native to Chainlink used to incentivize the entire network. Furthermore LINK tokens serve as payment currency for Node operators also postulating as an asset on different exchanges. The value as well as the use of the token is set on the notion of adoption of the Chainlink network. The total supply of LINK tokens is a finite 1 billion, with only 381 million currently in circulation.

This scarcity eventually adds value to the token with the passage of time, as demand for the LINK tokens increases. The company currently owns 30% of the token for continuous development. 35% of the one billion tokens were dedicated to the ICO, and the remaining 35% tokens were dedicated to incentivizing the network in the form of Node Operator payments. To this day in terms of ROI, Chainlink has been one of the most successful ICOs in the history of DeFi.

Major uses of Chainlink

- In the case of an insurable event, data from external sources are used. Devices enabled by the Internet of Things expel data feeds that can be used to define insurable events. Their use case for insurable smart contracts is unquestionable.

- Chainlink project can also be effectively used for bonds and smart contracts that are based on interest rate derivatives. Data from financial websites are accessed and require APIs to conclude reporting on the prevalent market prices.

- They also can be used for completing contractual obligations. Data in these contracts can be given through GPS or ERP systems so as to ensure everything fits perfectly.

Use-case of Smart contracts for financial cases

With the help of Smart contracts, trust can be renewed again within the financial sector and its markets. It evaporates any risk associated with counterparties in international trade.

Risky financial products like derivatives can easily be decentralized and automated without the need for any intermediaries. Chainlink’s partnership with the SWIFT banking system has been regarded as one of the most path-breaking concepts. Smart Contract developed a Proof of Concept for SWIFT with the help of Chainlink. This concept was lauded for its ability to automate bond coupon payments. It successfully demonstrated the PoC at the SWIFT Sibos Conference in 2017 where it easily showed off-chain interest rate data from 5 different banks. It also generated an ISO2022 SWIFT message to complete the payment.

Recent Chainlink Data

The Link market cap is valued presently at $1.64 billion with a circulating token supply of 381,009,558 tokens. The present spot price also stands valued 22% below the highest point it achieved this year.

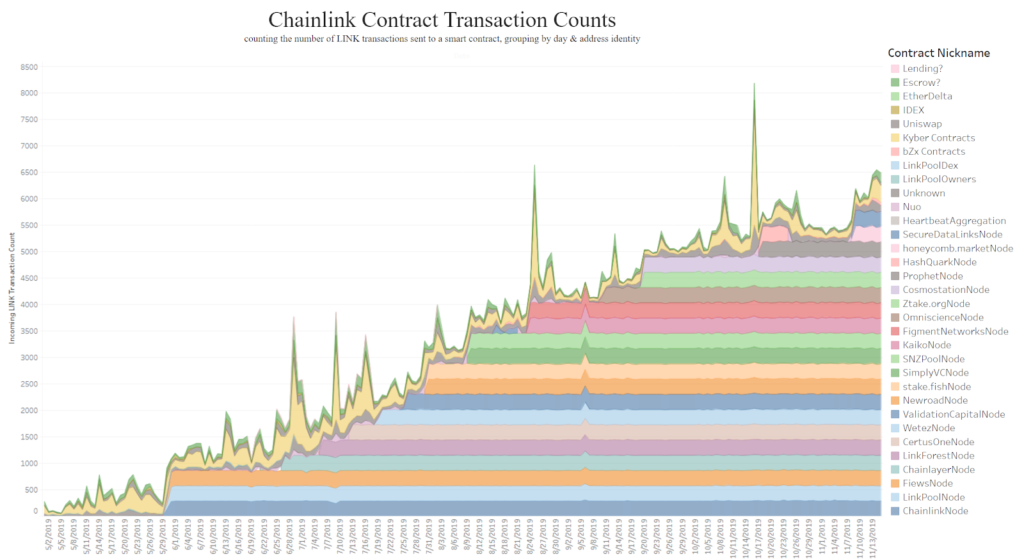

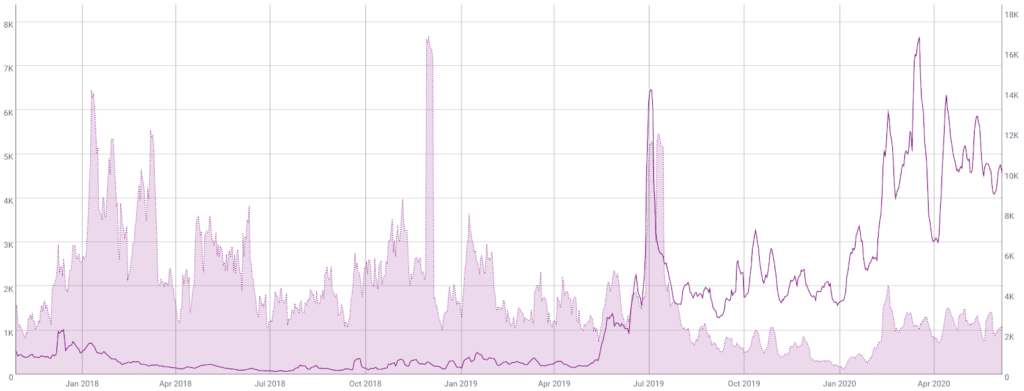

From the network’s perspective, the volumes of on-chain transactions per day and the transaction value seem to be inversely related as per the chart above. This year the average transactions per day touched it’s all-time high of 7,600. Since February the average transaction values have hovered between US$1,500 to US$4,500.

What will the future hold for Chainlink?

Looking at the strong background of the company’s founders and advisors, the major partnerships, and the increasing integrations, Chainlink is undoubtedly making waves across the DeFi sector. Every day there is more and more adoption of Chainlink. Just yesterday, Kyber Network, the decentralized exchange, announced they would be integrating Chainlink for their price feeds.

Just as Bitcoin was the first mainstream decentralized currency and Ethereum was the first mainstream decentralized smart contract platform, Chainlink is the first mainstream decentralized oracle.

2020 could very well be Chainlink’s best year yet.

trading

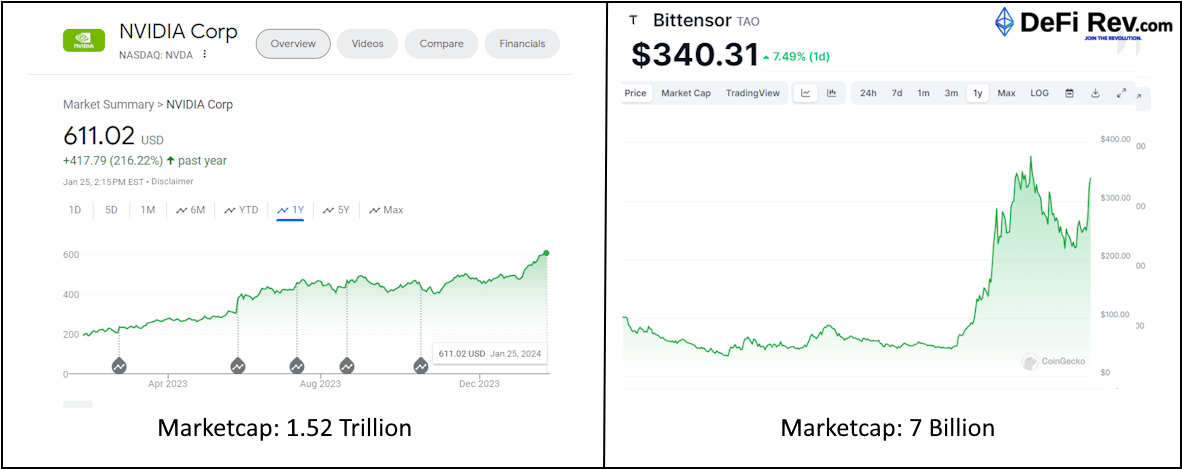

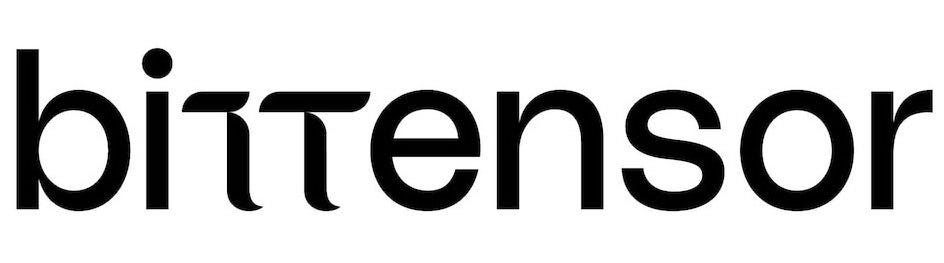

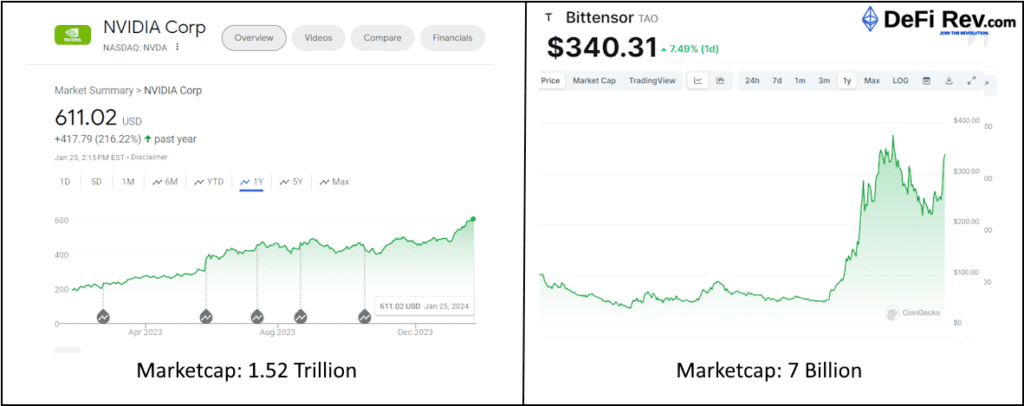

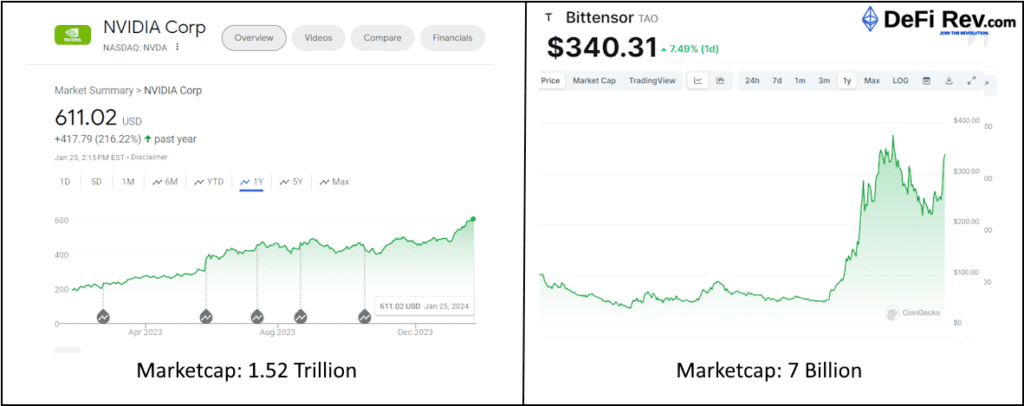

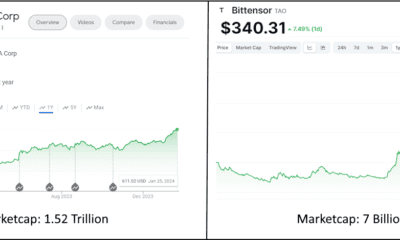

Bittensor booms as Chip Mania hits Stock Market: The AI Race and the Potential of TAO

The stock market has been abuzz with the latest trend in technology investments: semiconductor chips. This “chip mania” is fueled by the global race for artificial intelligence (AI) supremacy, as chips are the fundamental building blocks of AI and machine learning technologies. As companies and countries vie for the lead in AI, the demand for advanced semiconductor chips has skyrocketed, leading to significant interest from investors. In this context, Bittensor, with its unique decentralized approach to AI, emerges as a potentially strategic investment.

Nvidia and Bittensor might seem quite different at first glance—one is a big name in computer graphics, and the other is part of the exciting world of decentralized networks. But they actually have a lot in common, especially when it comes to artificial intelligence .

The AI Race and Chip Demand

AI has become a critical component of modern technology, from consumer applications like voice assistants to complex systems such as autonomous vehicles and smart cities. The performance of AI systems is heavily dependent on the processing power provided by semiconductor chips. As AI models become more sophisticated, they require more computational resources, driving the demand for high-performance chips.

This demand has led to a surge in investments in chip manufacturers and designers. Companies like NVIDIA, AMD, and Intel have seen their stock prices soar as they continue to push the boundaries of chip performance. The market has also witnessed the rise of specialized AI chip startups, all competing to create the most efficient and powerful processors.

Supply Chain Challenges and Investment Opportunities

The increased demand for chips has not been without its challenges. The global semiconductor supply chain has been under strain, with issues such as the COVID-19 pandemic, trade tensions, and production bottlenecks leading to shortages. These shortages have highlighted the critical nature of chips in the global economy and have spurred further investment as companies seek to secure their supply chains.

Investors are keenly aware of the strategic importance of semiconductors and are looking for opportunities to capitalize on the chip mania. This has led to a bullish outlook on chip stocks, with many analysts predicting continued growth as the AI race heats up. This also has led to a boon from smart money to look into Bittensor.

Bittensor: A Decentralized Approach to AI

Nvidia and Bittensor might seem quite different at first glance—one is a big name in computer graphics, and the other is part of the exciting world of decentralized networks. But they actually have a lot in common, especially when it comes to artificial intelligence (AI). Let’s break down how they’re both helping to push technology forward:

Nvidia makes the powerful graphics cards that a lot of AI programs need to run. Bittensor, on the other hand, gives people a place to run AI programs on a network that’s spread out across many computers. Nvidia is always coming up with new ideas for its graphics technology, which is super important for video games, AI, and big calculations. Bittensor is also all about new ideas, but it’s focused on making AI services that don’t rely on just one place or computer.

Nvidia has a huge group of developers who use its tech to create all sorts of things, and it helps them out with special software and tools. Bittensor also depends on a community, but it’s made up of developers and people who contribute computer power to the network, and they get rewarded with digital tokens.

Both Nvidia and Bittensor have lots of room to grow, but in different ways. Nvidia is growing because more and more industries need its graphics cards. Bittensor’s growth is tied to how many people start using decentralized AI services and how the whole area of digital currencies and blockchain technology gets bigger.

Now, let’s imagine it’s two years from now, and Bittensor has really taken off. Here’s what that could look like:

Everyone’s Using Decentralized AI

Bittensor’s network is the go-to place for AI services that aren’t tied to one spot. There’s a big group of smart people and companies using and adding to the network.

Even small companies or solo developers can make cool AI stuff because Bittensor makes it easy to get to machine learning tools and computer power.

Amidst the frenzy for traditional chip stocks, Bittensor presents a novel investment opportunity. Bittensor is not a chip manufacturer; rather, it is a decentralized network that leverages the collective power of distributed machine-learning models. By pooling together the resources of miners across the globe, Bittensor facilitates the creation and operation of AI models in a decentralized manner.

The Bittensor network offers several advantages to Nvidia that could make it an attractive investment:

The Bittensor network offers several advantages that could make it a competitor to Nvidia.

Decentralization: Unlike centralized AI services, Bittensor is not reliant on a single entity or data center. This reduces the risk of outages and censorship, potentially leading to a more robust and resilient AI network.

Incentivization

Miners on the Bittensor network are rewarded for contributing computational resources and for the performance of their AI models. This creates a marketplace for AI services where competition drives innovation and efficiency.

Scalability

As the demand for AI grows, Bittensor’s decentralized model allows for easy scaling by simply adding more miners to the network. This contrasts with the physical limitations and capital expenditures required to scale traditional data centers.

Accessibility

Bittensor democratizes access to AI by allowing anyone with computational resources to participate as a miner. This could lead to a more diverse and widespread development of AI applications.

The chip mania in the stock market is a reflection of the critical role that semiconductors play in the burgeoning AI industry. While traditional chip stocks are an obvious choice for investors looking to capitalize on this trend, Bittensor offers a unique angle. Its decentralized network aligns with the principles of blockchain and the growing interest in distributed systems.

trading

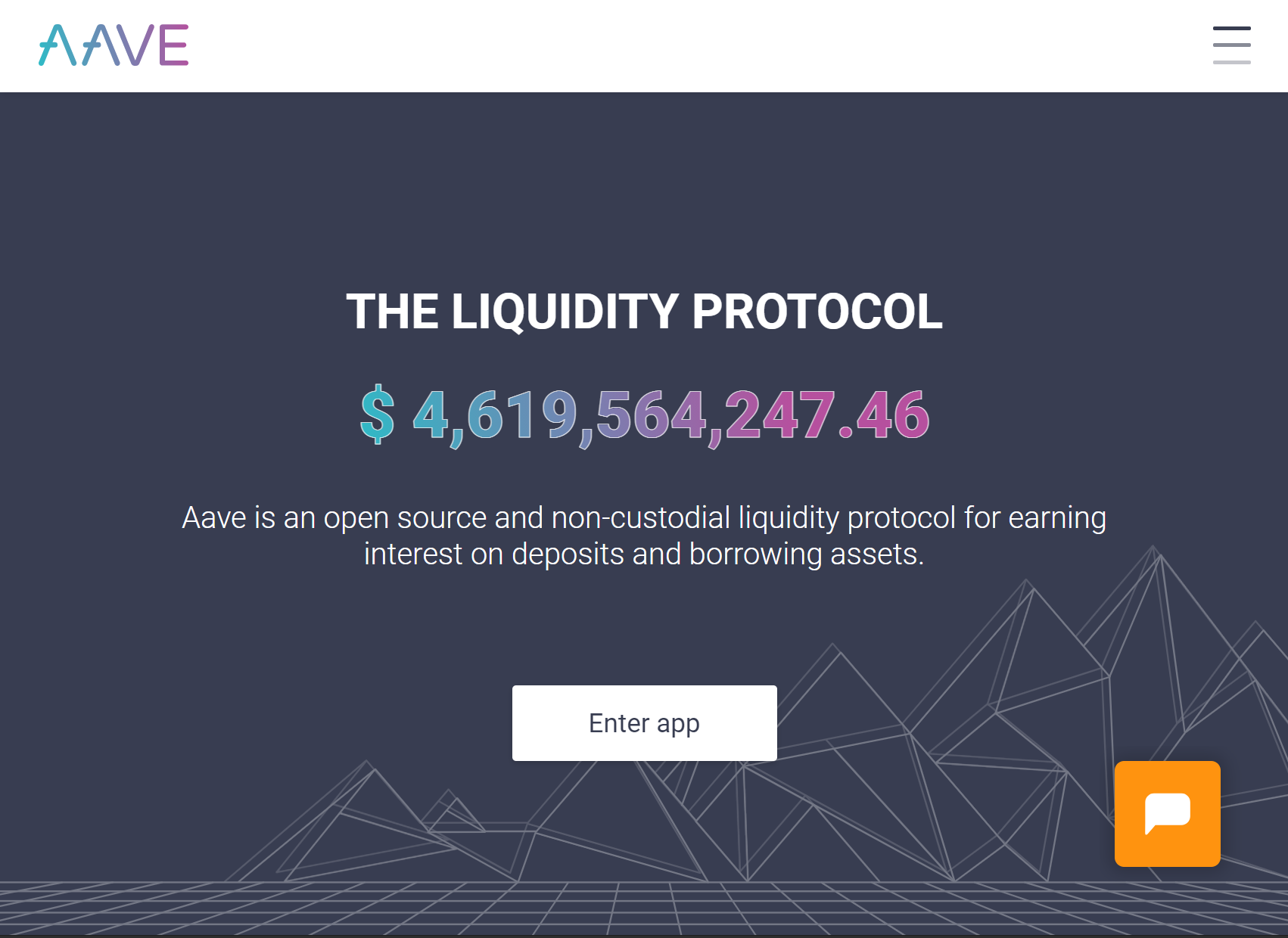

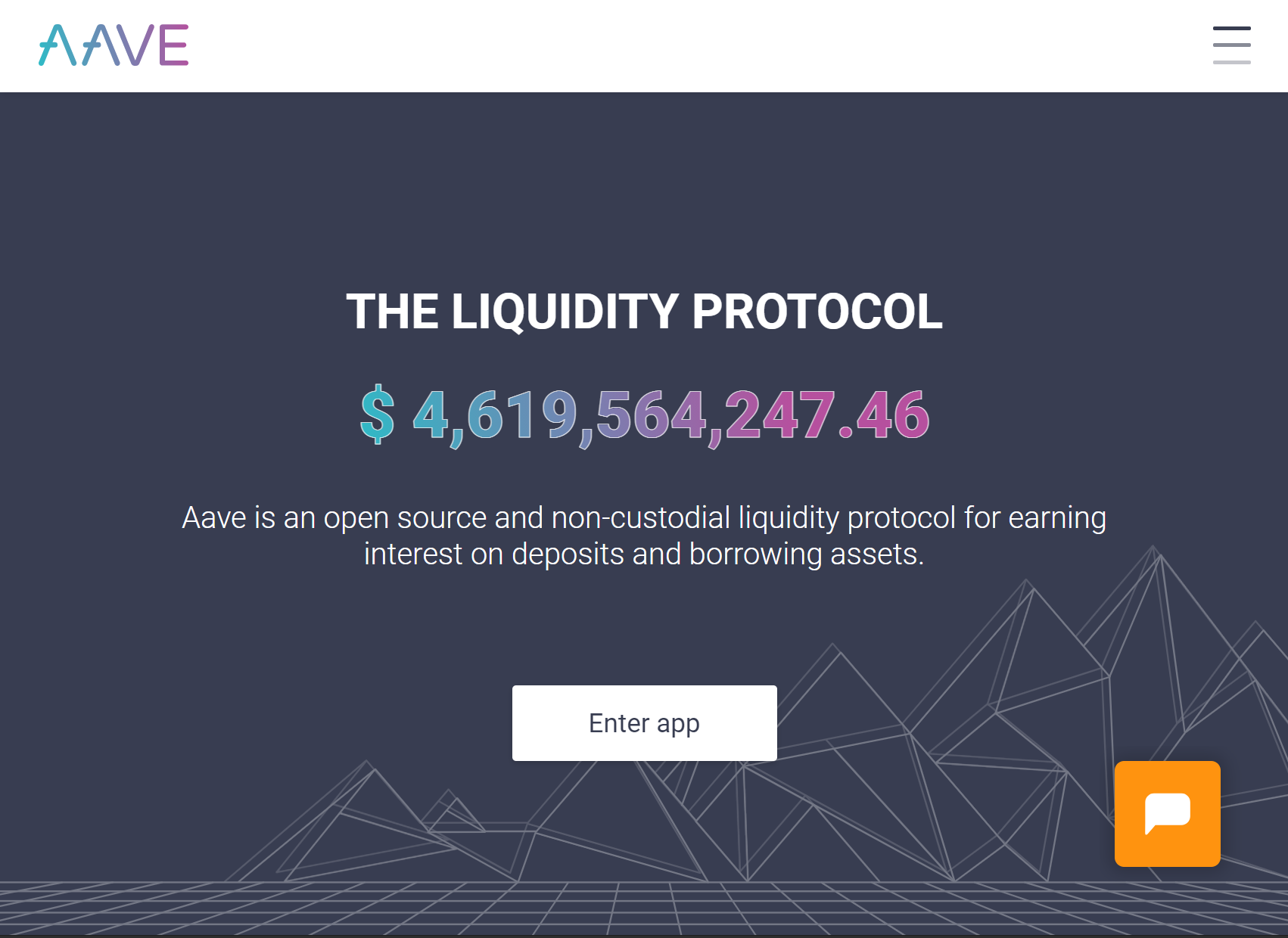

AAVE CRYPTO ASSET SOARING

AAVE SOARING TO NEW HEIGHTS AS IT BREAKS $500 USD

AAVE is on fire reaching new all-time highs in rapid succession. As of today, February 4th, 2021, an earth-shattering volume of nearly 3 billion dollars of AAVE was traded in the past 24 hours.

Aave clocks in a new ATH ever since the v2 migration tool launch

Aave (AAVE) has been going strong ever since February began. In just 5 days, AAVE has increased by 76% and today the token hit a new all-time high of $520. The protocol to date has successfully captured users and has done well against its competition. The latest rally for Aave started on Jan 28 when the protocol announced the v2 migration tool. The tool allowed users to easily migrate all account information including the borrowed positions and staked tokens.

The new tool also facilitates easy migration of user information to the updated protocol. Recently on the 1’st of February, the team from Aave protocol posted an update about the same:

“Today is the last day to vote on the AIP to add $BAL on Aave V2.”

A day following the announcement the proposal was passed by the community. The Balancer (BAL) was added on Aave 2 and it was around that time that AAVE rallied from $284 to $300.

The DeFi platform of AAVE is also rejoicing since the platform is undergoing immense upgrades. As per DeFi pulse, the total value locked in the DeFi protocol is now at $4.96 billion ranked second after Maker which has $5.16 billion in total value locked.

AAVE, which is the 15th largest coin in terms of market cap, also recorded a staggering 24-hour trading period. Its trading volume in the last 24-hours touched $2.4 billion! Treyce Dahlem who is a research analyst believes that the recent surge in AAVE price has been fuelled by the big players and institutions who are becoming increasingly interested in DeFi.

He added, “Billionaire Mark Cuban recently spoke about the “unlimited upside” of DeFi and according to a snapshot of his on-chain portfolio, he is an AAVE whale holding more than $150,000 worth of the token. Grayscale recently filed more than a dozen altcoin trusts with Delaware’s corporate registry, one of those altcoins being AAVE. Additionally, Bitwise added AAVE to their Bitwise 10 Large Cap Crypto Index. These announcements have caused investor sentiment to reach a new YTD high of 83.5 (very high).”

AAVE is quickly becoming a household name in DeFi for its revolutionary approach to decentralized lending, and our analysts believe that with the stellar leadership of Stani Kulechov, the Founder and CEO of AAVE, we predict AAVE will move into the top 10 digital assets quite quickly.

It seems apparent that AAVE is the de facto industry leader in its sector, and we surmise that it will be the perfect way for the everyday individual to get their feet wet with DeFi.

Recently, the migration tool from V1 to V2 was made available.

trading

Ethereum 2.0 Launch: Staking, Launch Date, and More. Here’s everything you need to know.

HOT PROJECTS Ethereum 2.0 is a major upgrade to the Ethereum Network that aims to improve the speed, efficiency, and scalability of the network. Ethereum is up for a major facelift with the new version release which will state to drastically improve its transaction volumes, alleviate congestion, and high gas costs. Upon reaching the final phase of the upgrade, dubbed as ‘Phase 2’ Ethereum will meet the goals of being a 100% transparent and open network for decentralized finance. Ethereum 2.0 will involve sharding to drastically augment the bandwidth and reduce gas cost making it cheaper to send Ethereum, tokens, and interact with smart contracts. The system will undergo fundamental economic changes also allowing support to stake nodes and earn Ethereum as passive income. Ethereum 2.0 is a unified effort of thousands of developers who have put in years of hard work.The Ethereum 2.0 upgrade will be done in 3 distinct phases starting with Phase 0. After having faced criticism for the network’s high transaction costs and fragility during peak usage will Ethereum 2.0 stand up for the challenge? This we will come to know once the launch is successfully built and practiced. The next generation of Ethereum Blockchain will go live on December 1’st and will go from a Proof-Of-Work model to a Proof-Of-Stake model where participants can tie their crypto to the network as collateral. As per the announcement, for the launch to really happen, 16384 validators will have to stake a minimum of 32 Ether worth $12,800 at current market rates thereby underpinning the network. Once the threshold has been staked it will trigger the launch of Beacon Chain in the Ethereum 2.0 genesis event. The most important change is that the consensus mechanism will transition from PoW to PoS which is touted to be more effective and energy-efficient in terms of network maintenance. Both PoW and PoS are designed to incentivize network maintenance ensuring that the blockchain data is tamper-proof. Hence in a PoW system, one unit of computational power equals one unit of mining power, and in PoS one unit of value secures one unit of mining power for the validator. In Proof of Stake validators stake crypto for the right to verify the transaction. The validators are selected to propose a block based on the amount of crypto they hold and the duration of how long they have held it. The main advantage of PoS is that it is far more energy-efficient than PoW as it disengages energy-intensive computer processing from the consensus algorithm. This also means that there is a lot of computing power to secure the blockchain.The other big change is the introduction of network sharding which will happen at a later phase. Sharding implies that only a portion of the nodes has to validate any given transaction instead of all of them. This will directly increase the network’s throughput in a big way. The original PoW chain will concurrently run alongside so that there is no break in data continuity. Phase 1 is due in 2021 and will see the integration of Proof Of Stake shard chains. One of the reasons calling for the upgrade has been scalability. Ethereum 1.0 can only support 30 TPS causing delays and congestions. Ethereum 2.0 promises up to 100,000 transactions per second through the implementation of shard chains. The new version has also been designed with security in mind. Most of the Proof of Stake networks have a small set of validators making it a more centralized system with poor network security.Furthermore, Ethereum 2.0 requires a minimum of 16,384 validators making it ultra-secure. The Ethereum Foundation is also setting up a dedicated security team for Ethereum 2.0 which will research all the possible cybersecurity issues that plague the cryptocurrency sector. One of the top researchers for Ethereum 2.0, Justin Drake said that the research will also include “fuzzing, bounty hunting, pager duty, crypto-economic modeling, applied cryptanalysis, formal verification”. The co-founder of Ethereum Vitalik shared a roadmap of how the next few years things will pan out for Ethereum in the below-given tweet. DeFiRev.com is #1 in DeFi News. Check back in soon to find out the latest in DeFi News.Ethereum 2.0 Launch: Staking, Launch Date, and More. Here’s everything you need to know.

Ethereum 2.0 – what it is and why is it necessary?

What’s different about this time?

The ProcessThe full roll-out of Ethereum 2.0 will take place in three phases: Phase 0, 1, and 2. Phase 0 as we know is aiming for a December 2020 launch date with other phases coming in the following years. Phase 0 is looking at the implementation of the Beacon chain that stores and manages the registry of validators and deploying the PoS consensus mechanism for Ethereum 2.0.

Ethereum 2.0 will be arguably much better than its earlier version

-

trading3 months ago

trading3 months agoBittensor booms as Chip Mania hits Stock Market: The AI Race and the Potential of TAO

-

interviews3 months ago

interviews3 months agoBobby Ong CoinGecko CEO: Interview with the Trailblazing Entrepreneur

-

latestnews3 months ago

latestnews3 months agoWhat is DeFi? Decentralized Finance explained.

-

latestnews3 months ago

latestnews3 months agoPayPal Crypto Bound! PayPal is betting on bitcoin and DeFi in a BIG way.

-

trading3 months ago

trading3 months agoInjective Protocol, the new Binance IEO, packs a punch

-

trading3 months ago

trading3 months agoAAVE CRYPTO ASSET SOARING

-

trading3 months ago

trading3 months agoUniSwap Heating up BIG TIME! Is this the end of IEOs? New DeFi Projects fundraising on Uniswap.

-

Uncategorized3 months ago

Uncategorized3 months agoLitecoin MimbleWimble Update -Privacy upgrade to push fungibility with Mimblewimble on Extension Blocks