trading

Ethereum 2.0 Launch: Staking, Launch Date, and More. Here’s everything you need to know.

HOT PROJECTS Ethereum 2.0 is a major upgrade to the Ethereum Network that aims to improve the speed, efficiency, and scalability of the network. Ethereum is up for a major facelift with the new version release which will state to drastically improve its transaction volumes, alleviate congestion, and high gas costs. Upon reaching the final phase of the upgrade, dubbed as ‘Phase 2’ Ethereum will meet the goals of being a 100% transparent and open network for decentralized finance. Ethereum 2.0 will involve sharding to drastically augment the bandwidth and reduce gas cost making it cheaper to send Ethereum, tokens, and interact with smart contracts. The system will undergo fundamental economic changes also allowing support to stake nodes and earn Ethereum as passive income. Ethereum 2.0 is a unified effort of thousands of developers who have put in years of hard work.The Ethereum 2.0 upgrade will be done in 3 distinct phases starting with Phase 0. After having faced criticism for the network’s high transaction costs and fragility during peak usage will Ethereum 2.0 stand up for the challenge? This we will come to know once the launch is successfully built and practiced. The next generation of Ethereum Blockchain will go live on December 1’st and will go from a Proof-Of-Work model to a Proof-Of-Stake model where participants can tie their crypto to the network as collateral. As per the announcement, for the launch to really happen, 16384 validators will have to stake a minimum of 32 Ether worth $12,800 at current market rates thereby underpinning the network. Once the threshold has been staked it will trigger the launch of Beacon Chain in the Ethereum 2.0 genesis event. The most important change is that the consensus mechanism will transition from PoW to PoS which is touted to be more effective and energy-efficient in terms of network maintenance. Both PoW and PoS are designed to incentivize network maintenance ensuring that the blockchain data is tamper-proof. Hence in a PoW system, one unit of computational power equals one unit of mining power, and in PoS one unit of value secures one unit of mining power for the validator. In Proof of Stake validators stake crypto for the right to verify the transaction. The validators are selected to propose a block based on the amount of crypto they hold and the duration of how long they have held it. The main advantage of PoS is that it is far more energy-efficient than PoW as it disengages energy-intensive computer processing from the consensus algorithm. This also means that there is a lot of computing power to secure the blockchain.The other big change is the introduction of network sharding which will happen at a later phase. Sharding implies that only a portion of the nodes has to validate any given transaction instead of all of them. This will directly increase the network’s throughput in a big way. The original PoW chain will concurrently run alongside so that there is no break in data continuity. Phase 1 is due in 2021 and will see the integration of Proof Of Stake shard chains. One of the reasons calling for the upgrade has been scalability. Ethereum 1.0 can only support 30 TPS causing delays and congestions. Ethereum 2.0 promises up to 100,000 transactions per second through the implementation of shard chains. The new version has also been designed with security in mind. Most of the Proof of Stake networks have a small set of validators making it a more centralized system with poor network security.Furthermore, Ethereum 2.0 requires a minimum of 16,384 validators making it ultra-secure. The Ethereum Foundation is also setting up a dedicated security team for Ethereum 2.0 which will research all the possible cybersecurity issues that plague the cryptocurrency sector. One of the top researchers for Ethereum 2.0, Justin Drake said that the research will also include “fuzzing, bounty hunting, pager duty, crypto-economic modeling, applied cryptanalysis, formal verification”. The co-founder of Ethereum Vitalik shared a roadmap of how the next few years things will pan out for Ethereum in the below-given tweet. DeFiRev.com is #1 in DeFi News. Check back in soon to find out the latest in DeFi News.Ethereum 2.0 Launch: Staking, Launch Date, and More. Here’s everything you need to know.

Ethereum 2.0 – what it is and why is it necessary?

What’s different about this time?

The ProcessThe full roll-out of Ethereum 2.0 will take place in three phases: Phase 0, 1, and 2. Phase 0 as we know is aiming for a December 2020 launch date with other phases coming in the following years. Phase 0 is looking at the implementation of the Beacon chain that stores and manages the registry of validators and deploying the PoS consensus mechanism for Ethereum 2.0.

Ethereum 2.0 will be arguably much better than its earlier version

trading

Bittensor booms as Chip Mania hits Stock Market: The AI Race and the Potential of TAO

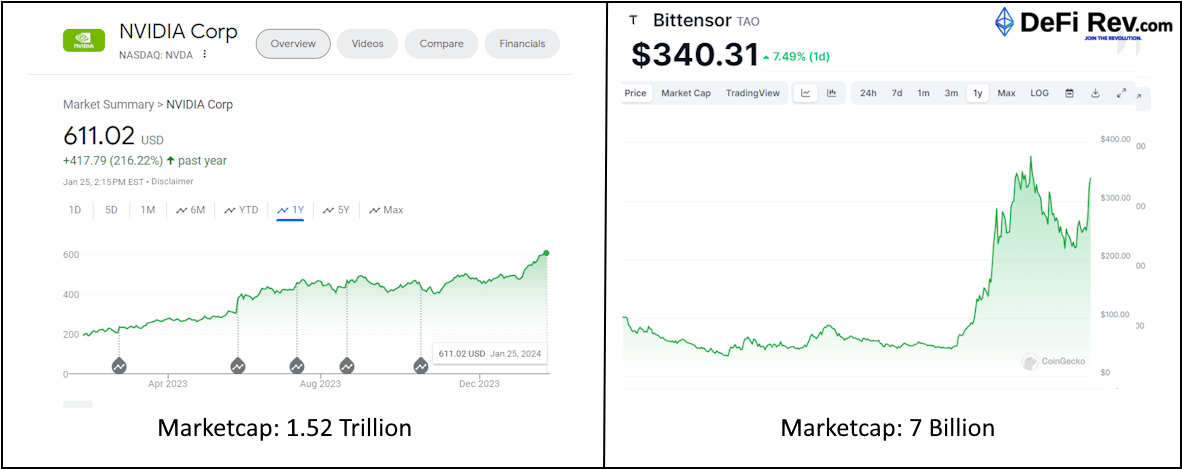

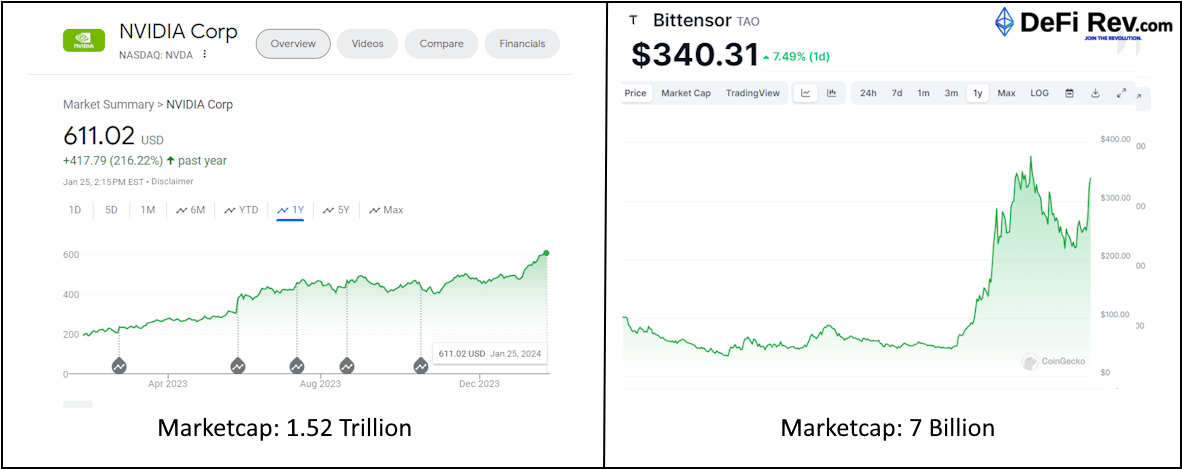

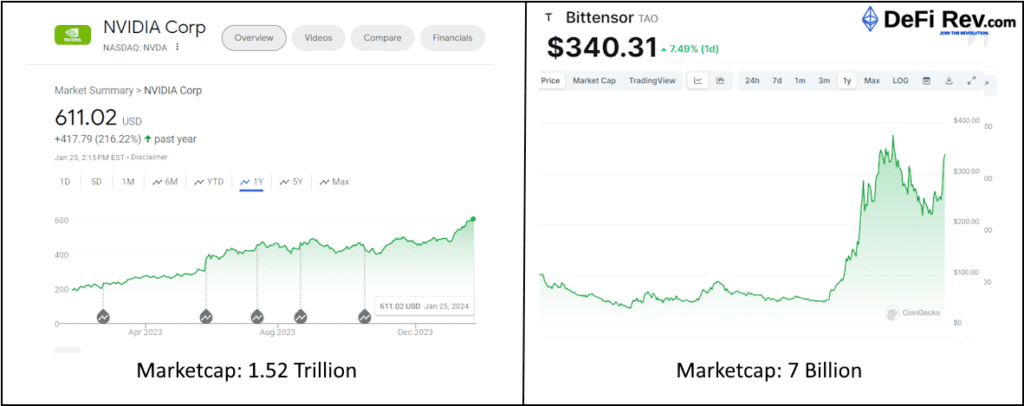

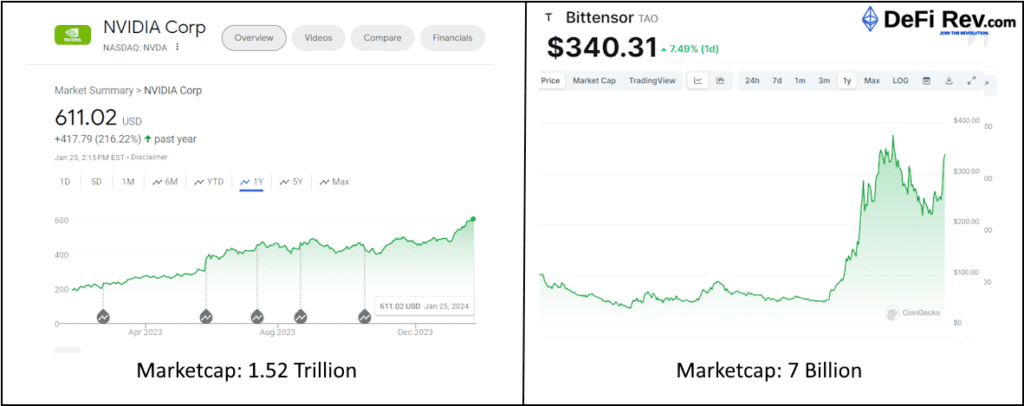

The stock market has been abuzz with the latest trend in technology investments: semiconductor chips. This “chip mania” is fueled by the global race for artificial intelligence (AI) supremacy, as chips are the fundamental building blocks of AI and machine learning technologies. As companies and countries vie for the lead in AI, the demand for advanced semiconductor chips has skyrocketed, leading to significant interest from investors. In this context, Bittensor, with its unique decentralized approach to AI, emerges as a potentially strategic investment.

Nvidia and Bittensor might seem quite different at first glance—one is a big name in computer graphics, and the other is part of the exciting world of decentralized networks. But they actually have a lot in common, especially when it comes to artificial intelligence .

The AI Race and Chip Demand

AI has become a critical component of modern technology, from consumer applications like voice assistants to complex systems such as autonomous vehicles and smart cities. The performance of AI systems is heavily dependent on the processing power provided by semiconductor chips. As AI models become more sophisticated, they require more computational resources, driving the demand for high-performance chips.

This demand has led to a surge in investments in chip manufacturers and designers. Companies like NVIDIA, AMD, and Intel have seen their stock prices soar as they continue to push the boundaries of chip performance. The market has also witnessed the rise of specialized AI chip startups, all competing to create the most efficient and powerful processors.

Supply Chain Challenges and Investment Opportunities

The increased demand for chips has not been without its challenges. The global semiconductor supply chain has been under strain, with issues such as the COVID-19 pandemic, trade tensions, and production bottlenecks leading to shortages. These shortages have highlighted the critical nature of chips in the global economy and have spurred further investment as companies seek to secure their supply chains.

Investors are keenly aware of the strategic importance of semiconductors and are looking for opportunities to capitalize on the chip mania. This has led to a bullish outlook on chip stocks, with many analysts predicting continued growth as the AI race heats up. This also has led to a boon from smart money to look into Bittensor.

Bittensor: A Decentralized Approach to AI

Nvidia and Bittensor might seem quite different at first glance—one is a big name in computer graphics, and the other is part of the exciting world of decentralized networks. But they actually have a lot in common, especially when it comes to artificial intelligence (AI). Let’s break down how they’re both helping to push technology forward:

Nvidia makes the powerful graphics cards that a lot of AI programs need to run. Bittensor, on the other hand, gives people a place to run AI programs on a network that’s spread out across many computers. Nvidia is always coming up with new ideas for its graphics technology, which is super important for video games, AI, and big calculations. Bittensor is also all about new ideas, but it’s focused on making AI services that don’t rely on just one place or computer.

Nvidia has a huge group of developers who use its tech to create all sorts of things, and it helps them out with special software and tools. Bittensor also depends on a community, but it’s made up of developers and people who contribute computer power to the network, and they get rewarded with digital tokens.

Both Nvidia and Bittensor have lots of room to grow, but in different ways. Nvidia is growing because more and more industries need its graphics cards. Bittensor’s growth is tied to how many people start using decentralized AI services and how the whole area of digital currencies and blockchain technology gets bigger.

Now, let’s imagine it’s two years from now, and Bittensor has really taken off. Here’s what that could look like:

Everyone’s Using Decentralized AI

Bittensor’s network is the go-to place for AI services that aren’t tied to one spot. There’s a big group of smart people and companies using and adding to the network.

Even small companies or solo developers can make cool AI stuff because Bittensor makes it easy to get to machine learning tools and computer power.

Amidst the frenzy for traditional chip stocks, Bittensor presents a novel investment opportunity. Bittensor is not a chip manufacturer; rather, it is a decentralized network that leverages the collective power of distributed machine-learning models. By pooling together the resources of miners across the globe, Bittensor facilitates the creation and operation of AI models in a decentralized manner.

The Bittensor network offers several advantages to Nvidia that could make it an attractive investment:

The Bittensor network offers several advantages that could make it a competitor to Nvidia.

Decentralization: Unlike centralized AI services, Bittensor is not reliant on a single entity or data center. This reduces the risk of outages and censorship, potentially leading to a more robust and resilient AI network.

Incentivization

Miners on the Bittensor network are rewarded for contributing computational resources and for the performance of their AI models. This creates a marketplace for AI services where competition drives innovation and efficiency.

Scalability

As the demand for AI grows, Bittensor’s decentralized model allows for easy scaling by simply adding more miners to the network. This contrasts with the physical limitations and capital expenditures required to scale traditional data centers.

Accessibility

Bittensor democratizes access to AI by allowing anyone with computational resources to participate as a miner. This could lead to a more diverse and widespread development of AI applications.

The chip mania in the stock market is a reflection of the critical role that semiconductors play in the burgeoning AI industry. While traditional chip stocks are an obvious choice for investors looking to capitalize on this trend, Bittensor offers a unique angle. Its decentralized network aligns with the principles of blockchain and the growing interest in distributed systems.

trading

AAVE CRYPTO ASSET SOARING

AAVE SOARING TO NEW HEIGHTS AS IT BREAKS $500 USD

AAVE is on fire reaching new all-time highs in rapid succession. As of today, February 4th, 2021, an earth-shattering volume of nearly 3 billion dollars of AAVE was traded in the past 24 hours.

Aave clocks in a new ATH ever since the v2 migration tool launch

Aave (AAVE) has been going strong ever since February began. In just 5 days, AAVE has increased by 76% and today the token hit a new all-time high of $520. The protocol to date has successfully captured users and has done well against its competition. The latest rally for Aave started on Jan 28 when the protocol announced the v2 migration tool. The tool allowed users to easily migrate all account information including the borrowed positions and staked tokens.

The new tool also facilitates easy migration of user information to the updated protocol. Recently on the 1’st of February, the team from Aave protocol posted an update about the same:

“Today is the last day to vote on the AIP to add $BAL on Aave V2.”

A day following the announcement the proposal was passed by the community. The Balancer (BAL) was added on Aave 2 and it was around that time that AAVE rallied from $284 to $300.

The DeFi platform of AAVE is also rejoicing since the platform is undergoing immense upgrades. As per DeFi pulse, the total value locked in the DeFi protocol is now at $4.96 billion ranked second after Maker which has $5.16 billion in total value locked.

AAVE, which is the 15th largest coin in terms of market cap, also recorded a staggering 24-hour trading period. Its trading volume in the last 24-hours touched $2.4 billion! Treyce Dahlem who is a research analyst believes that the recent surge in AAVE price has been fuelled by the big players and institutions who are becoming increasingly interested in DeFi.

He added, “Billionaire Mark Cuban recently spoke about the “unlimited upside” of DeFi and according to a snapshot of his on-chain portfolio, he is an AAVE whale holding more than $150,000 worth of the token. Grayscale recently filed more than a dozen altcoin trusts with Delaware’s corporate registry, one of those altcoins being AAVE. Additionally, Bitwise added AAVE to their Bitwise 10 Large Cap Crypto Index. These announcements have caused investor sentiment to reach a new YTD high of 83.5 (very high).”

AAVE is quickly becoming a household name in DeFi for its revolutionary approach to decentralized lending, and our analysts believe that with the stellar leadership of Stani Kulechov, the Founder and CEO of AAVE, we predict AAVE will move into the top 10 digital assets quite quickly.

It seems apparent that AAVE is the de facto industry leader in its sector, and we surmise that it will be the perfect way for the everyday individual to get their feet wet with DeFi.

Recently, the migration tool from V1 to V2 was made available.

trading

Bancor V2 : Liquidity Reloaded

Bancor V2 – Liquidity reloaded

One of the primary concerns surrounding trading new cryptos is limited liquidity. Most digital assets are traded against the two most popular cryptocurrencies, Bitcoin, and Ethereum which further aggravates the liquidity problem. New Crypto and DeFi entrants can get discouraged because there is a limited choice available to them along with the woes of higher transaction costs and fees that some centralized exchanges have.

In comes Bancor, a solid blockchain protocol that attempts to bridge this difference. Bancor lets users convert their diverse virtual currency tokens almost instantly without the need to exchange them on any cryptocurrency exchange. Virtual coins can be traded which goes a long way in combating the liquidity battle. Its new network is built on a new class of cryptocurrencies called smart tokens and smart contracts.

Bancor V2 – Features

July 2020, the release of Bancor Version 2 is imminent and we intend to elucidate all that you must know what the V2 has up its sleeve.

- Bancor V2 attacks the liquidity problem in the heart by providing 100% disclosure to a single token.

- The bonding curve that represents the relationship between price and token supply has worked out to become more performance-oriented. This has reduced slippage meaning the difference between the expected price of a trade and the actual trade execution price has reduced considerably.

- An integration of Chainlink price oracles with Automated market maker (AMM) has ensured the reduction of impermanent loss which is the difference between holding tokens in an AMM and what you hold in your wallet.

- There is also increased support for other lending protocols.

Problems that Bancor V2 will solve

Increased Slippage:

Slippages can happen anytime, but it occurs the most when market orders are used in volatile markets. It also can happen when a large order is executed but the volume falls short at the selected price to maintain the present bid/ask spread.AMM’s have been at the receiving end for needing huge amounts of liquidity to achieve volumes with order-book based exchanges.

Solution

- Flexible bonding curve that aims to magnify the capital efficacy of AMM’s.

- The new bonding curve will reduce slippage by using up pooled resources within the price conversion intervals.

- Liquidity providers will now be able to conjointly fund AMM’s which will guarantee more volumes with limited capital requirement.

Impermanent Loss mitigation

AMM technology sure has taken off but users who provide liquidity to AMM’s have experienced devaluation of their staked tokens relative to token holding. This risk known as the impermanent loss has deterred many commercial institutional users from provisioning liquidity.

Source: Defirate

Solution

- Bancor V2 helps create AMM’S with pinned liquidity reserves which will enable holding the relative value of reserves stable. It will use prices from ChainLink’s price oracles. Curve’s stablecoin pool is a fitting example of a successful AMM building with pegged reserves but they are limited to stablecoins and synthetic coins.

- But this new version does not restrict itself to stablecoins or wrapped tokens expanding its solution to even volatile assets. Liquidity providers just need to hold the token to which liquidity is being provided.

- Token teams and end-users benefit from good profits from trading fees.

Single token exposure

We now know that AMM’s needed liquidity providers to maintain exposure to tokens in their reserves. Users contribute their resources to a network by parking their tokens in a smart contract for autonomous swaps. The more the capital in AMM, the easier it is for other users to swap the token. But, the community-sourced liquidity faces a hurdle that is taking exposure to a separate reserve asset while providing liquidity.

Solution

- 100% exposure to single ERC20 token. Liquidity providers do not need any reserve token.

- Option to select exposure to any token in AMM open from 0-100%.

- Liquidity providers can maintain their long position while they earn rewards and trading fees.

Lending interest

Liquidity providers faced a constant issue of low profitability because of their decreased ability to earn lending interest. The interoperability of open source De Fi protocols also was questionable.

Solution

- AMM’s integrated lending protocols will allow liquidity providers to generate lending interest on top of trading fees.

- Liquidity can be added or removed with ERC20 tokens. AMM’s will utilize wrappers for lending and reverse-lending the tokens.

- Liquidity providers can now realize higher profitability.

With the new version, Bancor will rope in more liquidity to the protocol. Being experts in the liquidity pool, Bancor V2 intends to create disruption by decreasing the opportunity costs and driving further profits.

DeFiRev.com is #1 in DeFi News. Check back in soon to find out the latest Bancor V2 updates & the latest in DeFi News.

-

trading10 months ago

trading10 months agoBittensor booms as Chip Mania hits Stock Market: The AI Race and the Potential of TAO

-

latestnews10 months ago

latestnews10 months agoPayPal Crypto Bound! PayPal is betting on bitcoin and DeFi in a BIG way.

-

trading10 months ago

trading10 months agoInjective Protocol, the new Binance IEO, packs a punch

-

trading10 months ago

trading10 months agoUniSwap Heating up BIG TIME! Is this the end of IEOs? New DeFi Projects fundraising on Uniswap.

-

interviews10 months ago

interviews10 months agoBobby Ong CoinGecko CEO: Interview with the Trailblazing Entrepreneur

-

latestnews10 months ago

latestnews10 months agoWhat is DeFi? Decentralized Finance explained.

-

trading10 months ago

trading10 months agoAAVE CRYPTO ASSET SOARING

-

Uncategorized10 months ago

Uncategorized10 months agoLitecoin MimbleWimble Update -Privacy upgrade to push fungibility with Mimblewimble on Extension Blocks