news

PayPal Crypto Bound! PayPal is betting on bitcoin and DeFi in a BIG way.

PayPal is betting on bitcoin and DeFi in a big way. Here’s what you need to know.

PayPal shocked the financial world Monday, with rumors swirling of direct crypto sales to its 325 million customers along with its subsidiary Venmo. In a move that shook the crypto world, many pundits were taken back the news, as PayPal has a strong history of being a staunch opponent to crypto and DeFi.

PayPal’s core business is the facilitation of online payment service that allows both individuals and businesses to transfer funds with the help of electronic mode. It also is one of the first payment organizations to enable merchants to accept Bitcoin through Braintree with successful partnerships with payment processors like BitPay, GoCoin, and Coinbase. It also has integrated with Coinbase’s virtual currency wallet and exchange so that the users of Coinbase selling Bitcoin can withdraw the funds to their own PayPal accounts. Such alliances have helped PayPal build firm grounds and have provided it valuable market insights that will shape their future decisions.

PayPal also strongly believes that Blockchain technology holds immense potential especially in the world of finance. Its engagement with the broader Blockchain ecosystem until now demonstrates its increasing bent towards it.

PayPal & Crypto

In its list of firsts, PayPal is now looking at working with multiple cryptocurrency exchanges to source liquidity. Earlier PayPal was solely a means to withdraw funds from these exchanges but now it will for the first time proffer the direct sales of crypto. An industry source also opined that exchanges will not offer direct buy and sell of crypto from PayPal and Venmo with the likelihood that there will be in-built wallet functionality for storage.

While the entire industry is positively headed with the news, it could take a close to 3 months before this service is outlined for mainstream use. PayPal and its team have denied commenting on anything on their plans as of now. As per the industry predictions, Coinbase and Bitstamp are speculated to by the partners of PayPal in this initiative. Yet, no official comment from Bitstamp or CoinBase has been forthcoming on this matter.

PayPal & Coinbase

The history of PayPal and Coinbase goes back to 2016. Coinbase made instantaneous fiat withdrawals to PayPal in 2018, it also allowed European Coinbase users to withdraw to their PayPal accounts. Crypto is interestingly and increasingly being viewed as the most obvious way to reinforce and strengthen the user base on fintech apps and also generate new avenues for revenue generation.

More DeFi Competition

Square which was launched by Twitter CEO also launched bitcoin purchases in its own cash app in 2018. Its cash app reported an enormous Bitcoin revenue of $306 million as per the latest report. Revolut in partnership with Bitstamp also started offering crypto to users in 2017 and had raised a whopping $500 million in February.

PayPal CEO Dan Schulman has also made it evident that it will aggressively push on monetizing Venmo already besotted with 52 million accounts. While the PayPal CTO refused to comment on explicit plans of PayPal, he went on the record to confirm that the organizations believe strongly in the strong perspectives of the blockchain technology and its foray into the digitization of currency is now not a question of IF but rather WHEN.

PayPal’s Aggressive Recruitments

Earlier this year, PayPal also recruited a workforce to structure and strengthen its Blockchain research group. It also had eight open engineering positions in San Jose and Singapore. The different job openings with its descriptions are now live and public on the job board of the company. The opening for Technical Lead/ Crypto engineer will be responsible for all novel PayPal initiatives around the globe to lead the pack with innovation and agility. The technical lead will be required to design, develop, and maintain the crypto features so that it promises future availability, performance, and scalability.

PayPal is also seeking a blockchain research engineer that will be a part of the Strategic Technology Enablement team. The expert has to establish their opinions on emerging blockchain technologies and their uses with PayPal. These job listings bear resemblance to the fact that PayPal is getting aggressive and is trying to move deeper into the cryptocurrency market. The job requirements it has listed require several skills that coincide with Bitcoin development. For instance, as per their website, they need people with experience in C++, cryptographic libraries, and asymmetric cryptography.

Paypal & Technological Advancement

As of now, official comments and announcements are awaited, but the suggestions are strong enough to indicate that its foray will reverberate within the industry, sending shockwaves throughout the entire financial sector once officially announced.

Even though Elon Musk left PayPal long ago, one could argue PayPal is taking some lessons from his genius. With Tesla, Musk used his talent to predict a future where cars running on oil would be a thing of the past, betting big on rechargeable automobiles and renewable energy.

PayPal is now looking at DeFi and crypto, in the same manner, looking to get ahead of an inevitable reality: money will increasingly become digital. Will cars running on oil or physical money cease to exist? Not for some time, but during the transition period, both Tesla and PayPal are looking to capitalize on a huge market share in a potential multi-trillion dollar industry.

Check back in at DeFiRev.com to find out the latest in DeFi News.

news

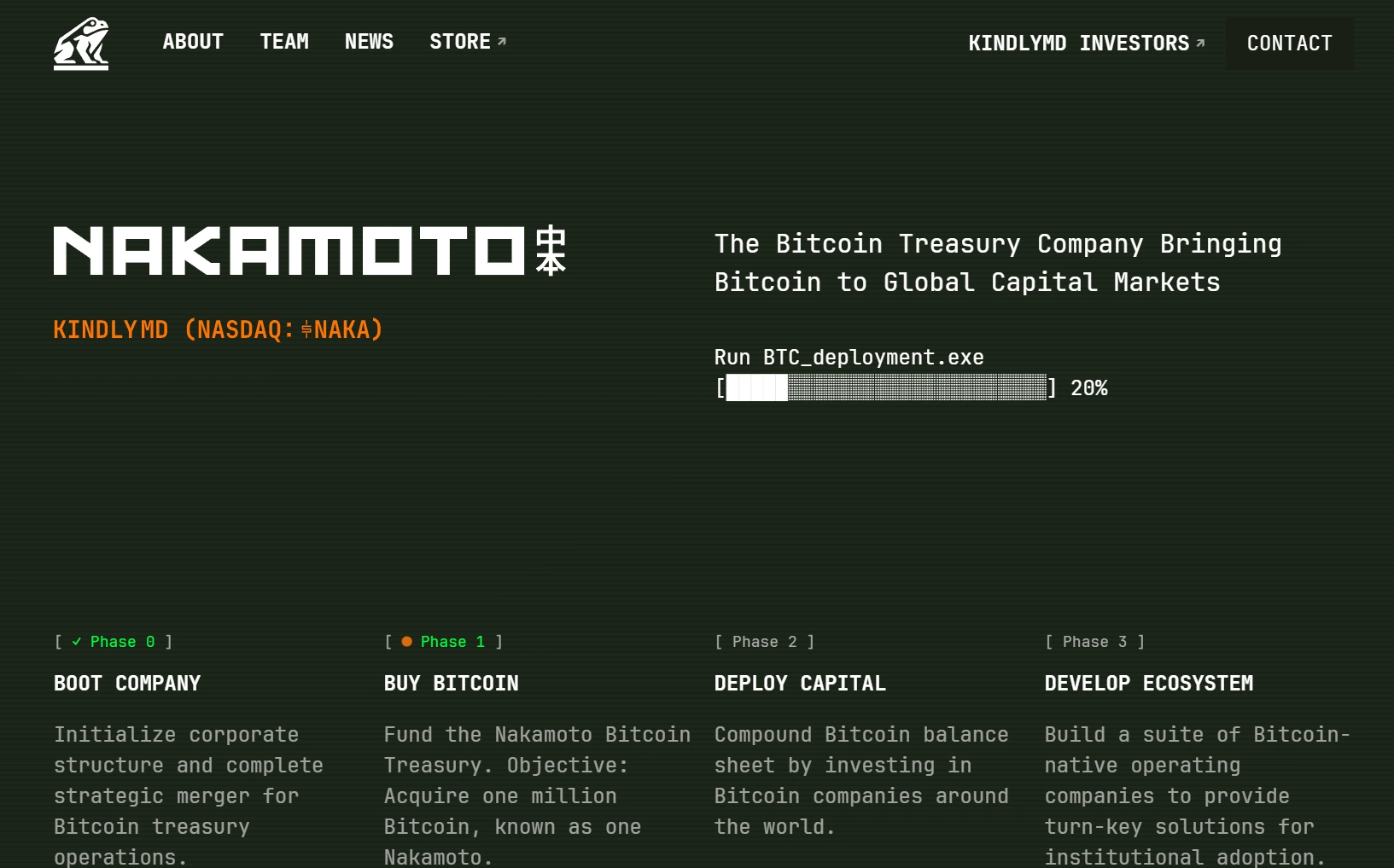

David Bailey’s Nakamoto creates Bitcoin Treasury with KindlyMD

David Bailey’s Bitcoin Treasury comes to life

On August 14, 2025, KindlyMD, Inc. (NASDAQ: NAKA) finalized its merger with Nakamoto Holdings Inc., a Bitcoin-native holding company, marking a bold step toward establishing a publicly traded Bitcoin treasury vehicle. The combined entity, retaining the KindlyMD name, will trade on the Nasdaq Capital Market under the ticker “NAKA,” with Nakamoto operating as a wholly-owned subsidiary focused on Bitcoin financial services. The merger, backed by $540 million in private placement (PIPE) financing and an anticipated $200 million convertible note offering, aims to fund significant Bitcoin acquisitions and drive global adoption.

David Bailey, Nakamoto’s founder and the combined company’s CEO, envisions a future where Bitcoin anchors global capital markets. “Since my journey in Bitcoin began 13 years ago, I’ve believed it will become the most valuable asset in history,” Bailey stated. The company’s ambitious goal is to acquire one million Bitcoin, leveraging innovative financial strategies to integrate the cryptocurrency into corporate and government treasuries.Bailey revealed his plan in a post on X (formerly Twitter) on Monday, writing:

$762M Allocation to Acquire 6,400 BTC

The $762.5 million allocation, rounded up in Bailey’s statement, will be used to acquire roughly 6,400 BTC at current market prices of about $118,892 per coin. The purchase will be executed using a Volume Weighted Average Price (VWAP) strategy to minimize slippage and avoid market disruption, rather than a straight market buy.

Building a $1B Bitcoin Treasury

This move is part of Bailey’s broader $1 billion Bitcoin accumulation goal, allowing Nakamoto to join the ranks of major corporate holders like MicroStrategy and Metaplanet. Following its merger with Nasdaq-listed KindlyMD earlier this year, Nakamoto has gained access to significant capital resources, having previously secured $710 million to fuel its Bitcoin treasury expansion.

Expanding Influence in the Bitcoin Space

Bailey, who also co-founded Bitcoin Magazine’s parent company BTC Inc., has described his vision as building a “Bitcoin juggernaut” that will become one of the largest holders in the world. He also took to X recently to signal his plans to raise up to $200 million for a political action committee to advance Bitcoin’s interests in the United States.

Corporate Bitcoin Holdings Continue to Rise

Nakamoto’s purchase comes amid a surge in corporate Bitcoin acquisitions, with over 1.24 million BTC now held by public and private companies worldwide, showing Bitcoin’s growing presence in institutional portfolios.

news

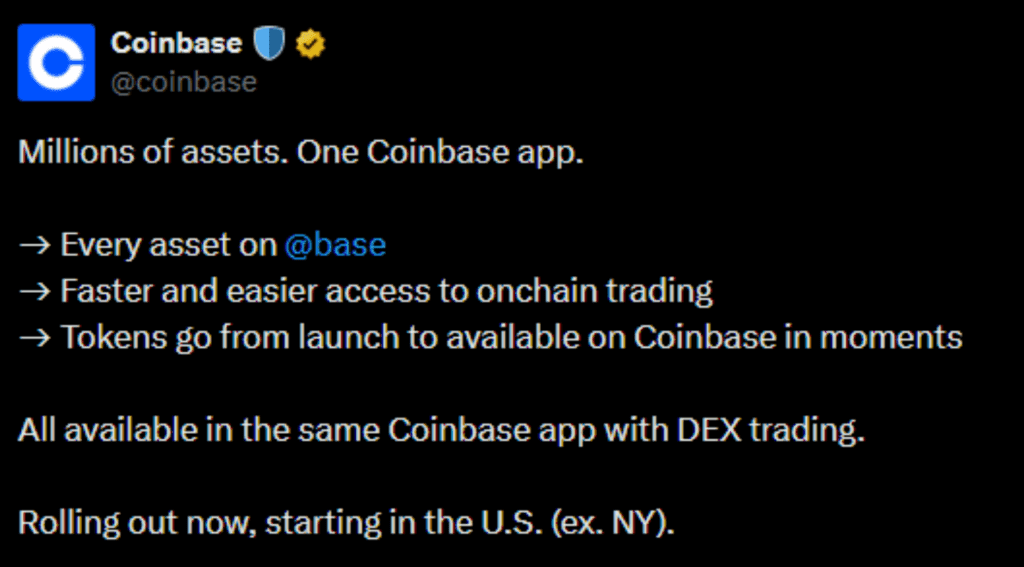

Coinbase DEX launches for the first time ever

Coinbase DEX has rolled out decentralized exchange (DEX) trading directly inside its app, giving users access to millions of onchain assets without leaving the platform. The launch is live for U.S. users outside New York State and runs on Coinbase’s Ethereum Layer 2 network, Base.

The feature introduces an integrated self-custody wallet, letting traders buy, sell, and manage tokens from the same interface they already use. Moreover, Coinbase is covering all network fees at launch, removing one of the main barriers to decentralized trading.

Faster Access to Onchain Markets

With the new Coinbase DEX integration, users can trade tokens within moments of their creation on Base. The initial rollout includes Base-native assets from projects like Virtuals AI Agents, Reserve Protocol DTFs, SoSo Value Indices, Auki Labs, and Super Champs. Support for new assets will be added in batches to maintain stable performance.

Trades are routed through Coinbase DEX aggregators that scan platforms like Aerodrome and Uniswap to secure the best available prices. Market data and risk insights are pulled directly from onchain sources, with Coinbase blocking access to tokens flagged as malicious by third-party security partners.

“A new era of access, going from just 300 assets yesterday to millions before long.” -Coinbase

Expansion Beyond Base

Coinbase plans to expand DEX trading to more networks, starting with Solana, and eventually to more countries. This move combines centralized convenience with decentralized freedom, offering portfolio management, fiat integration, and instant access to emerging tokens.

The company is positioning the update as part of its “everything exchange” vision, aiming to merge traditional listings with rapid onchain access. For traders and builders, this could mean faster entry to markets and a larger audience from day one.

news

Circle to Launch ARC Layer 1

USDC issuer Circle has announced plans to launch its own open Layer-1 blockchain, Arc, later this year. The network is designed specifically for stablecoin payments, foreign exchange, and capital markets, a move the company calls “the next era of stablecoin-native applications.” The announcement was made on August 12 through Circle’s official blog and X post:

Arc will be EVM-compatible and use USDC as its native gas token. This allows users to pay predictable, dollar-denominated transaction fees without holding volatile crypto assets. Other features include a built-in FX engine, deterministic sub-second settlement finality, and opt-in privacy controls.

Circle says Arc will be fully integrated across its platform and remain interoperable with the 24 blockchains already supporting USDC. The blockchain will run on Malachite, a high-performance consensus engine acquired from Informal Systems, and its core software will be released under an open-source license.

Based on their announcement, use cases for Arc range from cross-border payments and stablecoin FX markets to tokenized assets and on-chain credit systems. Circle aims to give developers and institutions a unified foundation to build stablecoin-powered applications at scale.

Arc will enter private testnet in the coming weeks, with a public testnet expected this fall and mainnet beta in 2026. As Circle put it, Arc is intended to be “the home for all forms of digital money and tokenized value,” bridging enterprise needs with the openness of public blockchain infrastructure.

-

trading2 years ago

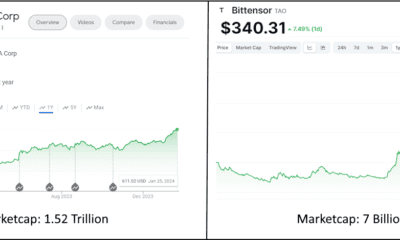

trading2 years agoBittensor booms as Chip Mania hits Stock Market: The AI Race and the Potential of TAO

-

trading2 years ago

trading2 years agoInjective Protocol, the new Binance IEO, packs a punch

-

trading2 years ago

trading2 years agoUniSwap Heating up BIG TIME! Is this the end of IEOs? New DeFi Projects fundraising on Uniswap.

-

trading5 years ago

trading5 years agoWhat is Solana? How SOL is aiming to solve scaling issues.

-

interviews2 years ago

interviews2 years agoBobby Ong CoinGecko CEO: Interview with the Trailblazing Entrepreneur

-

trading2 years ago

trading2 years agoAAVE CRYPTO ASSET SOARING

-

trading2 years ago

trading2 years agoEthereum 2.0 Launch: Staking, Launch Date, and More. Here’s everything you need to know.

-

trading2 years ago

trading2 years agoBancor V2 : Liquidity Reloaded