news

CRV Token Launch! Curve Finance Token launched after questionable start.

Amidst the frenzy, CRV Token is launched after a shaky start, some questions from the DeFi community have arisen.

The popular Decentralized finance project Curve was forced to launch its governance token CRV too soon thanks to an anonymous developer’s deployment of the contract without even the team knowing about it. The developers used a new account on Twitter and tweeted that he believed that the contracts were ready and went leap-frogging!

Source: Twitter

The Curve team in its preliminary response has confirmed that it is doubly verifying contracts and deployment benchmarks.

CRV Token Launch

After 7 hours of frantic confusion, research and brain-storming, the Curve team finally announced on Telegram and Discord that all was well, verified, and legitimate. It clarified on the record that the contracts have been thoroughly verified by the team to ensure that the correct deployment process has been followed. Curve DAO had been deployed by a community member and since the token/DAO received traction, they had no choice but to adopt it. The team has also assured that the anonymous users have been renounced of any admin powers.

The curve team went to further imply that they were skeptical initially and did the right checks. But, after the investigation, the deployment was completed with the correct code, admin keys, and data leaving them with no choice but accepting it and pushing forward the launch despite the official UI not ready!

So, August 14th marked the official launch of CRV opening the trading pair CRV/USDC on the decentralized trading platform Matcha. When the Curve was established, it did not achieve 100% decentralization which is what made them introduce its governance token CRV. With this Curve becomes a decentralized autonomous organization.

CurveDAO and Tokenomics

The new CurveDAO will allow CRV holders to decide on important developments by voting. Experienced CRV holders will have a better say and voting prioritization which will reduce the influence of wealthy holders.

The total supply of CRV is 3.03 billion with 1.3 billion marked as the circulating supply. CRV is being distributed by yield farming. Binance has also said that it will list CRV tokens soon enough when the deposits reach a sufficient level ensuring healthy market dynamics. Once the level is reached Binance will list CRV/BNB, CRV/BTC, CRV/BUSD & CRV/USDT trading pairs. Any further announcement will be made 30-minutes prior to the beginning of the trade.

The contracts were available on Github as they were open-source making its code accessible enabling the deployment on Ethereum. Curve operated under the assumption that this will not be a problem because no one would want to incur the deployment cost of more than $8000 in fees.

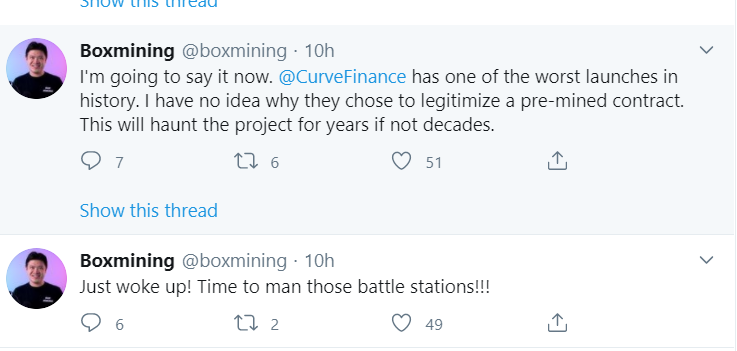

The community doesn’t seem too happy with several community members raising concerns about how fair the launch was. Popular influencer Boxmining was not too happy about it and expressed his concerns on his twitter handle.

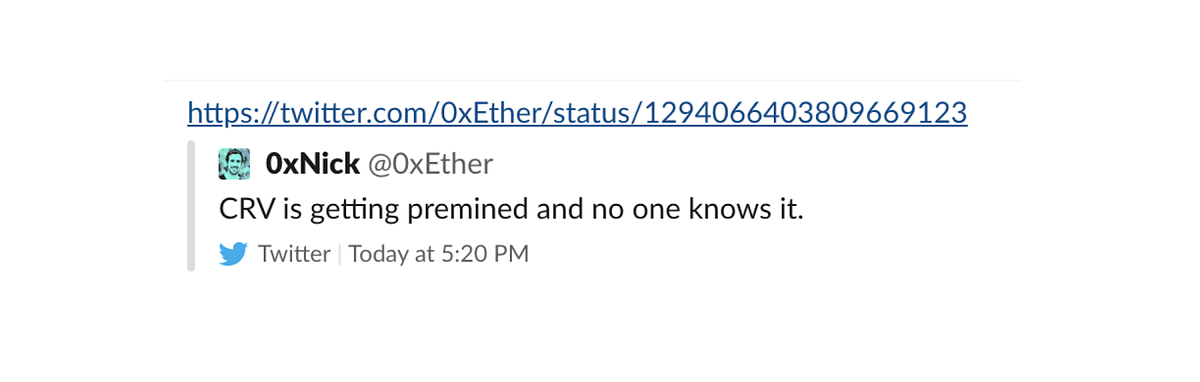

Despite the contract being deployed, users, later on, discovered that the wallets had been staking and earning CRV tokens ahead of the official launch which the curve users believe does not look good and reflect unfair “pre-mine” practices.

A fixed number of CRV tokens get awarded in each block and when you are the only person who is competing for it, then that user gets all the tokens for the block. This led to 20,000 CRV tokens awarded to those who staked early before even the official announcement took place. In fact, one of the wallets even belonged to the developer who prematurely launched the token.

Curve Finance is one of the most sought after projects in DeFi but the launch was rocky considering its reputation. It took the developer 19.9 ETH to deploy the contract. Amidst the frantic activity, the project lead requested the users to wait until the due diligence was complete and until it receives an official green signal from Curve.

Now that the much-awaited CRV token has been launched, users who have provided liquidity to the protocol will be entitled to the token distributions retroactively. The release will bring a change in distributed governance managed through the curveDAO. The reward mechanism and CurveDAO were audited by the security firm Quantstamp.

Dune Analytics has cited that Curve has become one of the most popular decentralized exchange protocols in recent months dominating more than 20% of all DEX volume in June and July.

CRV Token Price

According to CoinGecko, the highest price the CRV token reached was $54.01 USD, while the lowest price was $9.64 USD.

The CRV token is currently trading at $12.20 USD as of 1:44 pm Pacific Standard Time on August 14th, 2020.

news

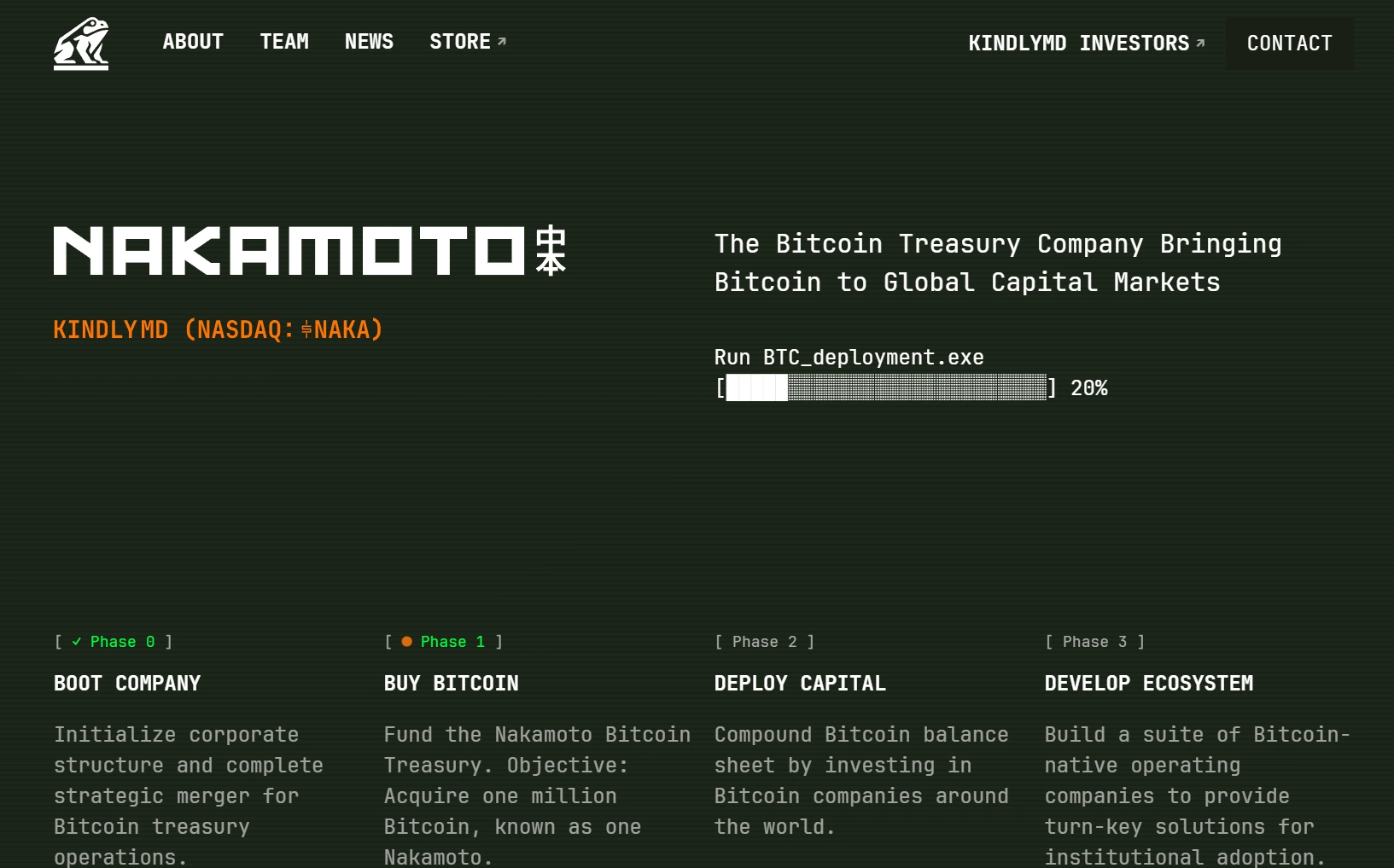

David Bailey’s Nakamoto creates Bitcoin Treasury with KindlyMD

David Bailey’s Bitcoin Treasury comes to life

On August 14, 2025, KindlyMD, Inc. (NASDAQ: NAKA) finalized its merger with Nakamoto Holdings Inc., a Bitcoin-native holding company, marking a bold step toward establishing a publicly traded Bitcoin treasury vehicle. The combined entity, retaining the KindlyMD name, will trade on the Nasdaq Capital Market under the ticker “NAKA,” with Nakamoto operating as a wholly-owned subsidiary focused on Bitcoin financial services. The merger, backed by $540 million in private placement (PIPE) financing and an anticipated $200 million convertible note offering, aims to fund significant Bitcoin acquisitions and drive global adoption.

David Bailey, Nakamoto’s founder and the combined company’s CEO, envisions a future where Bitcoin anchors global capital markets. “Since my journey in Bitcoin began 13 years ago, I’ve believed it will become the most valuable asset in history,” Bailey stated. The company’s ambitious goal is to acquire one million Bitcoin, leveraging innovative financial strategies to integrate the cryptocurrency into corporate and government treasuries.Bailey revealed his plan in a post on X (formerly Twitter) on Monday, writing:

$762M Allocation to Acquire 6,400 BTC

The $762.5 million allocation, rounded up in Bailey’s statement, will be used to acquire roughly 6,400 BTC at current market prices of about $118,892 per coin. The purchase will be executed using a Volume Weighted Average Price (VWAP) strategy to minimize slippage and avoid market disruption, rather than a straight market buy.

Building a $1B Bitcoin Treasury

This move is part of Bailey’s broader $1 billion Bitcoin accumulation goal, allowing Nakamoto to join the ranks of major corporate holders like MicroStrategy and Metaplanet. Following its merger with Nasdaq-listed KindlyMD earlier this year, Nakamoto has gained access to significant capital resources, having previously secured $710 million to fuel its Bitcoin treasury expansion.

Expanding Influence in the Bitcoin Space

Bailey, who also co-founded Bitcoin Magazine’s parent company BTC Inc., has described his vision as building a “Bitcoin juggernaut” that will become one of the largest holders in the world. He also took to X recently to signal his plans to raise up to $200 million for a political action committee to advance Bitcoin’s interests in the United States.

Corporate Bitcoin Holdings Continue to Rise

Nakamoto’s purchase comes amid a surge in corporate Bitcoin acquisitions, with over 1.24 million BTC now held by public and private companies worldwide, showing Bitcoin’s growing presence in institutional portfolios.

news

Coinbase DEX launches for the first time ever

Coinbase DEX has rolled out decentralized exchange (DEX) trading directly inside its app, giving users access to millions of onchain assets without leaving the platform. The launch is live for U.S. users outside New York State and runs on Coinbase’s Ethereum Layer 2 network, Base.

The feature introduces an integrated self-custody wallet, letting traders buy, sell, and manage tokens from the same interface they already use. Moreover, Coinbase is covering all network fees at launch, removing one of the main barriers to decentralized trading.

Faster Access to Onchain Markets

With the new Coinbase DEX integration, users can trade tokens within moments of their creation on Base. The initial rollout includes Base-native assets from projects like Virtuals AI Agents, Reserve Protocol DTFs, SoSo Value Indices, Auki Labs, and Super Champs. Support for new assets will be added in batches to maintain stable performance.

Trades are routed through Coinbase DEX aggregators that scan platforms like Aerodrome and Uniswap to secure the best available prices. Market data and risk insights are pulled directly from onchain sources, with Coinbase blocking access to tokens flagged as malicious by third-party security partners.

“A new era of access, going from just 300 assets yesterday to millions before long.” -Coinbase

Expansion Beyond Base

Coinbase plans to expand DEX trading to more networks, starting with Solana, and eventually to more countries. This move combines centralized convenience with decentralized freedom, offering portfolio management, fiat integration, and instant access to emerging tokens.

The company is positioning the update as part of its “everything exchange” vision, aiming to merge traditional listings with rapid onchain access. For traders and builders, this could mean faster entry to markets and a larger audience from day one.

news

Circle to Launch ARC Layer 1

USDC issuer Circle has announced plans to launch its own open Layer-1 blockchain, Arc, later this year. The network is designed specifically for stablecoin payments, foreign exchange, and capital markets, a move the company calls “the next era of stablecoin-native applications.” The announcement was made on August 12 through Circle’s official blog and X post:

Arc will be EVM-compatible and use USDC as its native gas token. This allows users to pay predictable, dollar-denominated transaction fees without holding volatile crypto assets. Other features include a built-in FX engine, deterministic sub-second settlement finality, and opt-in privacy controls.

Circle says Arc will be fully integrated across its platform and remain interoperable with the 24 blockchains already supporting USDC. The blockchain will run on Malachite, a high-performance consensus engine acquired from Informal Systems, and its core software will be released under an open-source license.

Based on their announcement, use cases for Arc range from cross-border payments and stablecoin FX markets to tokenized assets and on-chain credit systems. Circle aims to give developers and institutions a unified foundation to build stablecoin-powered applications at scale.

Arc will enter private testnet in the coming weeks, with a public testnet expected this fall and mainnet beta in 2026. As Circle put it, Arc is intended to be “the home for all forms of digital money and tokenized value,” bridging enterprise needs with the openness of public blockchain infrastructure.

-

trading2 years ago

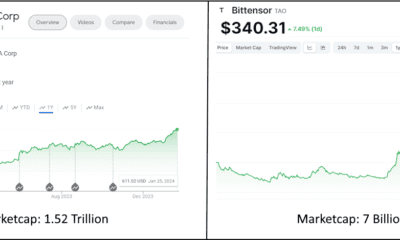

trading2 years agoBittensor booms as Chip Mania hits Stock Market: The AI Race and the Potential of TAO

-

news2 years ago

news2 years agoPayPal Crypto Bound! PayPal is betting on bitcoin and DeFi in a BIG way.

-

trading2 years ago

trading2 years agoInjective Protocol, the new Binance IEO, packs a punch

-

trading2 years ago

trading2 years agoUniSwap Heating up BIG TIME! Is this the end of IEOs? New DeFi Projects fundraising on Uniswap.

-

trading5 years ago

trading5 years agoWhat is Solana? How SOL is aiming to solve scaling issues.

-

interviews2 years ago

interviews2 years agoBobby Ong CoinGecko CEO: Interview with the Trailblazing Entrepreneur

-

trading2 years ago

trading2 years agoAAVE CRYPTO ASSET SOARING

-

trading2 years ago

trading2 years agoEthereum 2.0 Launch: Staking, Launch Date, and More. Here’s everything you need to know.