trading

Injective Protocol, the new Binance IEO, packs a punch

Binance announced its 16th project on Binance Launchpad, the Injective Protocol (INJ). The token sale for injective protocol followed a lottery format and Binance has completed the lottery draw for the protocol with the below-given outcome:

- A total of 22,175 total participants claimed a total of 157,870 tickets during the ticket claim period.

- 18,000 tickets have been won out of the 157,870 tickets claimed which showcases an 11.40% ticket win rate.

- An aggregate of 16,074 participants had at least one winning ticket implying that the user win rate was 72.4&%

As was decided, Binance recorded the user BNB balance for 6 days right from 13/10/2020 to 19/10/2020. It determined the final BNB holding amount for each user based on the average of the 6 days. In order to do so, it used the daily average BNB balance calculation which was also previously announced on its website.

Binance Launchpad which is an exclusive token launch platform for transformative blockchain projects announced a few days ago about its support for the first Universal DeFi protocol mainly intended for cross-chain derivatives trading. The injective protocol has become the first project which has been incubated by Binance Labs. The $3.6 million token sales which apparently took the lottery-format ticket claim began October 13 2020 at 0.00 AM (UTC).

What you should know about Injective protocol

The Injective protocol is undeniably the first-ever observed layer-2 decentralized exchange protocol which by design can successfully unravel the potential of decentralized cross-chain derivatives trading as well as borderless DeFi.

INJ is the native token of the Injective protocol which can be used across a wide range of functionalities including the governance of protocol much on the lines of the popular Yearn.Finance.

The governance decisions will be reached through a DAO structure, liquidity mining, and staking. The platform also intends to provide support to a vast array of derivative products like CFDs, perpetual swaps, and much more.

Important features of Injective protocol

- With its layer-2 decentralized derivatives trading, Injective will be able to achieve a great trading speed without the charge of any gas fees for trading. The level-2 architecture is something new and unseen in the DeFi space and makes it happen.

- Injective also has finer capabilities of supporting a wide array of yield generation and trading across distinct layer-1 blockchain networks.

- The injective protocol also will allow the users to create and trade on any derivative markets including synthetic and crypto-assets. They can choose which they want with a price feed. Thanks to this, the users will be able to witness a huge window of limitless opportunities for trading on markets that otherwise may not be found on other exchanges.

- As mentioned earlier governance of the injective protocol like Yearn.finance is governed by its decentralized community. This means that new listings or any changes in the network are done based on the votes via a DAO structure.

- The injective protocol is promoted for its speed because it scales trade execution and settlement on layer-2 along with providing the traders an almost instantaneous order cancellation with the help of its trade execution coordinator.

Injective Protocol : The value for the community

The community of the protocol can effectively grab the value from the network because it has several liquidity mining programs that have been natively built onto the network in order to grow on a continual basis. Injective is also rallying on the robust shoulders of social media with 23,000 members and still going strong.

The community can also find respite from the fact that the protocol has some of the biggest names in the corporate world. Its team has a great track record and hail from big companies such as Amazon Zeppelin. Some even have the experience of being associated with promising hedge funds. The team also boasts of people who are alumni of Ivy-league institutions such as Stanford. The protocol organization has currently established several partnerships with top DeFi and Blockchain networks including names like Elrond, Kava, and Findora.

Injective Protocol and why you should care

The platform makes use of both Ethereum and Cosmos ecosystems through the peg zones. It has built every component of the network to be entirely trustless censorship-resistant and publicly verifiable. Binance CEO said:

“It’s great to see more and more projects joining Binance Launchpad. We are pleased to provide our support for the Injective Protocol and help grow the DeFi space together. We’re looking forward to seeing Injective leverage decentralization to build a more efficient financial ecosystem”.

DeFiRev.com is #1 in DeFi News. Check back in soon to find out the latest in DeFi News.

trading

Pump.fun coin founders raise $1.32 billion

Pump.fun coin founders rake in billions

Pump.fun’s latest growth streak began with the conclusion of its public sale on July 12th, which brought in $1.32 billion across private and public rounds. The public portion alone, priced at $0.004 per token, raised $600 million in just 12 minutes. This was followed by the launch of $PUMP trading, with tokens distributed and markets opening within days, making it one of the largest crypto fundraises in recent years.

Following this, the team introduced a creator-fee redirection feature for projects hosted on PumpSwap or still within the bonding curve. This update allowed fees to be reassigned to active community leads in cases of leadership changes, provided there was a clear and verified request.

Pump.fun has also rolled out a public revenue dashboard, giving the community full visibility into daily platform earnings. Over a six-day period, the team bought back 8,740 SOL worth of $PUMP, exceeding the revenue generated during that time. In their words, it was about “putting our money where our mouth is” when it comes to reinvesting in the ecosystem.

Most recently, Pump.fun launched the Glass Full Foundation (GFF), a funding program for standout communities within its ecosystem, which are often called “diehard cults” internally. As part of this launch, the team has already awarded initial grants, with more recipients expected as the program scales.

From record-breaking fundraising to ecosystem reinvestment and targeted community funding, Pump.fun has spent the past several weeks strengthening its position as a leading Solana-based memecoin launchpad.

Go back to DeFiRev.com HOME

Go to Market Watch

trading

Bittensor booms as Chip Mania hits Stock Market: The AI Race and the Potential of TAO

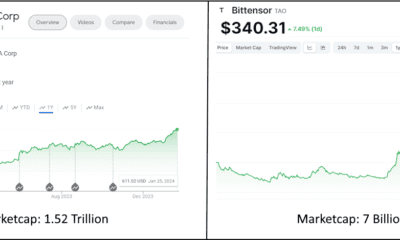

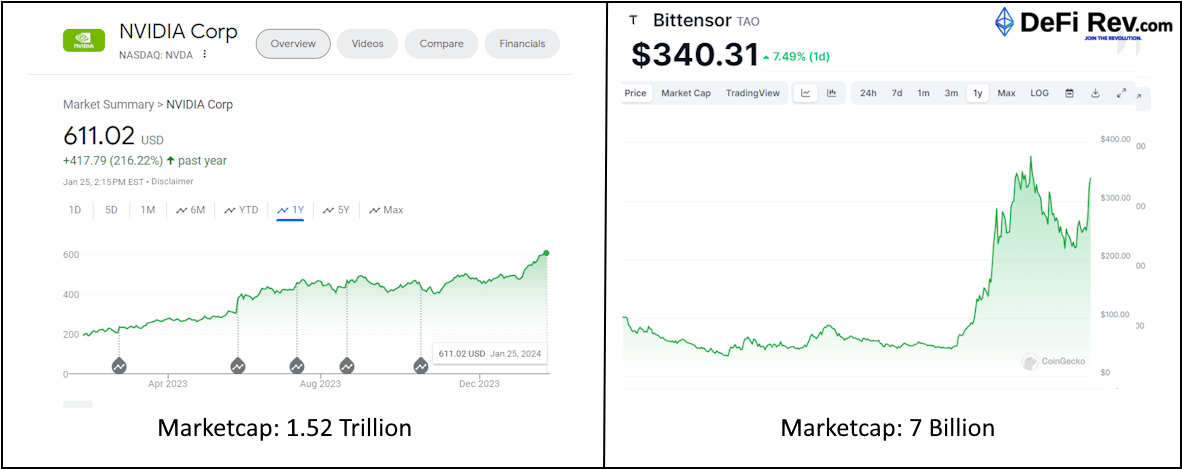

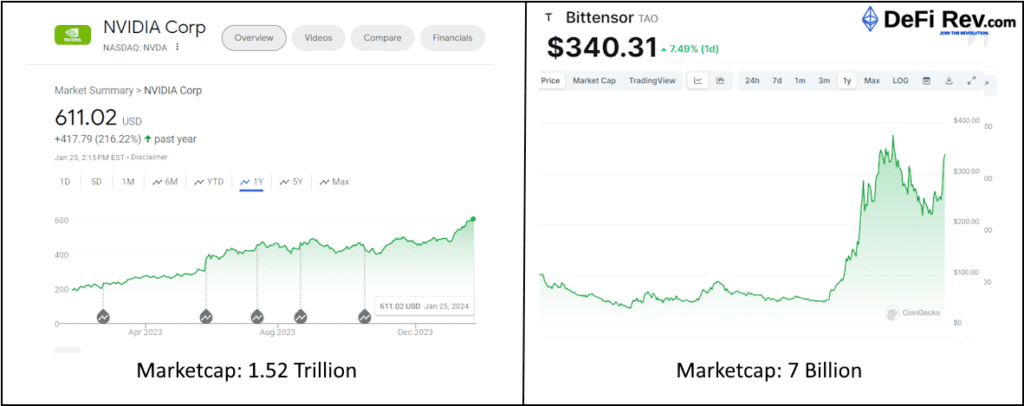

The stock market has been abuzz with the latest trend in technology investments: semiconductor chips. This “chip mania” is fueled by the global race for artificial intelligence (AI) supremacy, as chips are the fundamental building blocks of AI and machine learning technologies. As companies and countries vie for the lead in AI, the demand for advanced semiconductor chips has skyrocketed, leading to significant interest from investors. In this context, Bittensor, with its unique decentralized approach to AI, emerges as a potentially strategic investment.

Nvidia and Bittensor might seem quite different at first glance—one is a big name in computer graphics, and the other is part of the exciting world of decentralized networks. But they actually have a lot in common, especially when it comes to artificial intelligence .

The AI Race and Chip Demand

AI has become a critical component of modern technology, from consumer applications like voice assistants to complex systems such as autonomous vehicles and smart cities. The performance of AI systems is heavily dependent on the processing power provided by semiconductor chips. As AI models become more sophisticated, they require more computational resources, driving the demand for high-performance chips.

This demand has led to a surge in investments in chip manufacturers and designers. Companies like NVIDIA, AMD, and Intel have seen their stock prices soar as they continue to push the boundaries of chip performance. The market has also witnessed the rise of specialized AI chip startups, all competing to create the most efficient and powerful processors.

Supply Chain Challenges and Investment Opportunities

The increased demand for chips has not been without its challenges. The global semiconductor supply chain has been under strain, with issues such as the COVID-19 pandemic, trade tensions, and production bottlenecks leading to shortages. These shortages have highlighted the critical nature of chips in the global economy and have spurred further investment as companies seek to secure their supply chains.

Investors are keenly aware of the strategic importance of semiconductors and are looking for opportunities to capitalize on the chip mania. This has led to a bullish outlook on chip stocks, with many analysts predicting continued growth as the AI race heats up. This also has led to a boon from smart money to look into Bittensor.

Bittensor: A Decentralized Approach to AI

Nvidia and Bittensor might seem quite different at first glance—one is a big name in computer graphics, and the other is part of the exciting world of decentralized networks. But they actually have a lot in common, especially when it comes to artificial intelligence (AI). Let’s break down how they’re both helping to push technology forward:

Nvidia makes the powerful graphics cards that a lot of AI programs need to run. Bittensor, on the other hand, gives people a place to run AI programs on a network that’s spread out across many computers. Nvidia is always coming up with new ideas for its graphics technology, which is super important for video games, AI, and big calculations. Bittensor is also all about new ideas, but it’s focused on making AI services that don’t rely on just one place or computer.

Nvidia has a huge group of developers who use its tech to create all sorts of things, and it helps them out with special software and tools. Bittensor also depends on a community, but it’s made up of developers and people who contribute computer power to the network, and they get rewarded with digital tokens.

Both Nvidia and Bittensor have lots of room to grow, but in different ways. Nvidia is growing because more and more industries need its graphics cards. Bittensor’s growth is tied to how many people start using decentralized AI services and how the whole area of digital currencies and blockchain technology gets bigger.

Now, let’s imagine it’s two years from now, and Bittensor has really taken off. Here’s what that could look like:

Everyone’s Using Decentralized AI

Bittensor’s network is the go-to place for AI services that aren’t tied to one spot. There’s a big group of smart people and companies using and adding to the network.

Even small companies or solo developers can make cool AI stuff because Bittensor makes it easy to get to machine learning tools and computer power.

Amidst the frenzy for traditional chip stocks, Bittensor presents a novel investment opportunity. Bittensor is not a chip manufacturer; rather, it is a decentralized network that leverages the collective power of distributed machine-learning models. By pooling together the resources of miners across the globe, Bittensor facilitates the creation and operation of AI models in a decentralized manner.

The Bittensor network offers several advantages to Nvidia that could make it an attractive investment:

The Bittensor network offers several advantages that could make it a competitor to Nvidia.

Decentralization: Unlike centralized AI services, Bittensor is not reliant on a single entity or data center. This reduces the risk of outages and censorship, potentially leading to a more robust and resilient AI network.

Incentivization

Miners on the Bittensor network are rewarded for contributing computational resources and for the performance of their AI models. This creates a marketplace for AI services where competition drives innovation and efficiency.

Scalability

As the demand for AI grows, Bittensor’s decentralized model allows for easy scaling by simply adding more miners to the network. This contrasts with the physical limitations and capital expenditures required to scale traditional data centers.

Accessibility

Bittensor democratizes access to AI by allowing anyone with computational resources to participate as a miner. This could lead to a more diverse and widespread development of AI applications.

The chip mania in the stock market is a reflection of the critical role that semiconductors play in the burgeoning AI industry. While traditional chip stocks are an obvious choice for investors looking to capitalize on this trend, Bittensor offers a unique angle. Its decentralized network aligns with the principles of blockchain and the growing interest in distributed systems.

trading

AAVE CRYPTO ASSET SOARING

AAVE SOARING TO NEW HEIGHTS AS IT BREAKS $500 USD

AAVE is on fire reaching new all-time highs in rapid succession. As of today, February 4th, 2021, an earth-shattering volume of nearly 3 billion dollars of AAVE was traded in the past 24 hours.

Aave clocks in a new ATH ever since the v2 migration tool launch

Aave (AAVE) has been going strong ever since February began. In just 5 days, AAVE has increased by 76% and today the token hit a new all-time high of $520. The protocol to date has successfully captured users and has done well against its competition. The latest rally for Aave started on Jan 28 when the protocol announced the v2 migration tool. The tool allowed users to easily migrate all account information including the borrowed positions and staked tokens.

The new tool also facilitates easy migration of user information to the updated protocol. Recently on the 1’st of February, the team from Aave protocol posted an update about the same:

“Today is the last day to vote on the AIP to add $BAL on Aave V2.”

A day following the announcement the proposal was passed by the community. The Balancer (BAL) was added on Aave 2 and it was around that time that AAVE rallied from $284 to $300.

The DeFi platform of AAVE is also rejoicing since the platform is undergoing immense upgrades. As per DeFi pulse, the total value locked in the DeFi protocol is now at $4.96 billion ranked second after Maker which has $5.16 billion in total value locked.

AAVE, which is the 15th largest coin in terms of market cap, also recorded a staggering 24-hour trading period. Its trading volume in the last 24-hours touched $2.4 billion! Treyce Dahlem who is a research analyst believes that the recent surge in AAVE price has been fuelled by the big players and institutions who are becoming increasingly interested in DeFi.

He added, “Billionaire Mark Cuban recently spoke about the “unlimited upside” of DeFi and according to a snapshot of his on-chain portfolio, he is an AAVE whale holding more than $150,000 worth of the token. Grayscale recently filed more than a dozen altcoin trusts with Delaware’s corporate registry, one of those altcoins being AAVE. Additionally, Bitwise added AAVE to their Bitwise 10 Large Cap Crypto Index. These announcements have caused investor sentiment to reach a new YTD high of 83.5 (very high).”

AAVE is quickly becoming a household name in DeFi for its revolutionary approach to decentralized lending, and our analysts believe that with the stellar leadership of Stani Kulechov, the Founder and CEO of AAVE, we predict AAVE will move into the top 10 digital assets quite quickly.

It seems apparent that AAVE is the de facto industry leader in its sector, and we surmise that it will be the perfect way for the everyday individual to get their feet wet with DeFi.

Recently, the migration tool from V1 to V2 was made available.

-

trading2 years ago

trading2 years agoBittensor booms as Chip Mania hits Stock Market: The AI Race and the Potential of TAO

-

news2 years ago

news2 years agoPayPal Crypto Bound! PayPal is betting on bitcoin and DeFi in a BIG way.

-

trading2 years ago

trading2 years agoUniSwap Heating up BIG TIME! Is this the end of IEOs? New DeFi Projects fundraising on Uniswap.

-

interviews2 years ago

interviews2 years agoBobby Ong CoinGecko CEO: Interview with the Trailblazing Entrepreneur

-

trading5 years ago

trading5 years agoWhat is Solana? How SOL is aiming to solve scaling issues.

-

trading2 years ago

trading2 years agoAAVE CRYPTO ASSET SOARING

-

trading2 years ago

trading2 years agoBancor V2 : Liquidity Reloaded

-

trading2 years ago

trading2 years agoEthereum 2.0 Launch: Staking, Launch Date, and More. Here’s everything you need to know.